2025 Economic Outlook

The American economy is entering 2025 with steady growth, characterized by a 2.4% GDP growth rate and strong consumer spending. The labor market remains robust, with expectations of adding 150,000 to 175,000 payroll jobs monthly and maintaining an unemployment rate close to 4%.

Economic Pros to Consider

- Steady Economic Expansion

- 20 consecutive months of real wage gains

- 48 uninterrupted months of job gains

- $26 trillion (19%) increase in net worth over two years

- Strong corporate profits expected to rise 14.8% in 2025

- Inflation gradually declining towards 2.0%

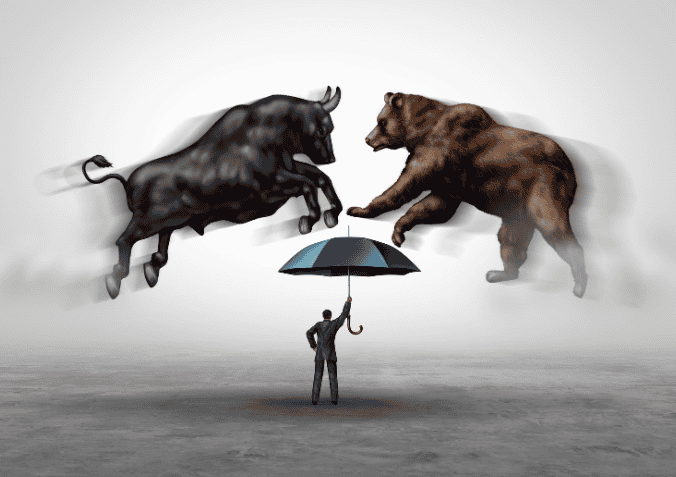

Economic Risk and Detractors to Consider

- Economic Risks and Extremes

- Potential disruptive policy changes (tariffs, immigration restrictions)

- Federal deficit potentially reaching $2.25 trillion (7.5% of GDP)

- Widening wealth inequality

- Market concentration risks

- Top 10 S&P500 stocks account for 39% of market cap

- U.S. stocks trading at high valuation levels

- Potential portfolio imbalances due to market performance

What Does The Economic Outlook Mean? Guidance Moving Forward

- Rebalance investment portfolios

- Consider global diversification

- Monitor potential policy shifts

- Be prepared for possible economic shocks

- Maintain a balanced approach to investing, recognizing both the economy’s resilience and potential vulnerabilities

If you have any financial planning or investing questions, please feel free to contact us for a free consultation.

You can reach us at 717-288-1880 or visit our contact us page to send an inquiry. We will be sure to respond within 24 hours.

About the Financial Authors

Alexander Langan, J.D, CFBS, currently serves as the Chief Investment Officer at Langan Financial Group. In this role, he manages investment portfolios, acts as a fiduciary for group retirement plans and consults with clients regarding their financial goals, risk tolerance and asset allocation.

With a focus on ERISA Law, Alex graduated cum laude from Widener Commonwealth Law School. He then clerked for the Supreme Court of Pennsylvania and worked in the Legal Office of the Pennsylvania Office of the Budget, where he assisted in directing and advising policy determinations on state and federal tax, administrative law, and contractual issues.

Alex is also passionate about giving back to the community, and has helped establish The Foundation of Enhancing Communities’ Emerging Philanthropist Program, volunteers at his church, and serves as a board member of Samara: The Center of Individual & Family Growth. Outside of work and volunteering, Alex enjoys his time with his wife Sarah and their three children, Rory, Patrick, and Ava.

About the Financial Planning Firm – Langan Financial Group

Langan Financial Group is an award winning independent financial planning firm with 10+ independent awards and over 100+ 5 star reviews.

Langan Financial Group has two financial planning locations – Harrisburg, Pa and York, Pa. Established in 1985, Langan Financial Group offers a broad range of financial planning services for individuals and organizations.

By being an independent firm, we are not required to sell any specific products or meet any specific quotas. As such, we are able to focus more on providing fiduciary services and customizing a specific personalized financial plan according to your needs.

Disclosures

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.