Understanding capital gains taxes can save you thousands of dollars on your tax bill. As we approach the second half of 2025, now is the perfect time to review your investment portfolio and plan tax-smart strategies for the remainder of the year.

Capital Gains Basics: What You Need to Know

Capital gains occur when you sell an investment for more than you paid for it. The profit from that sale is considered income by the IRS, but it’s taxed differently than your salary or wages.

There are two types of capital gains, and the difference between them can save you substantial money:

Short-term capital gains apply to investments you’ve owned for one year or less. These are taxed as ordinary income, meaning they’re added to your regular income and taxed at your normal tax rate, which can be as high as 37%.

Long-term capital gains apply to investments you’ve owned for more than one year. These receive preferential tax treatment with rates of 0%, 15%, or 20%, depending on your income level.

This distinction is crucial for your investment strategy. Holding an investment for just one day longer than a year can dramatically reduce your tax bill.

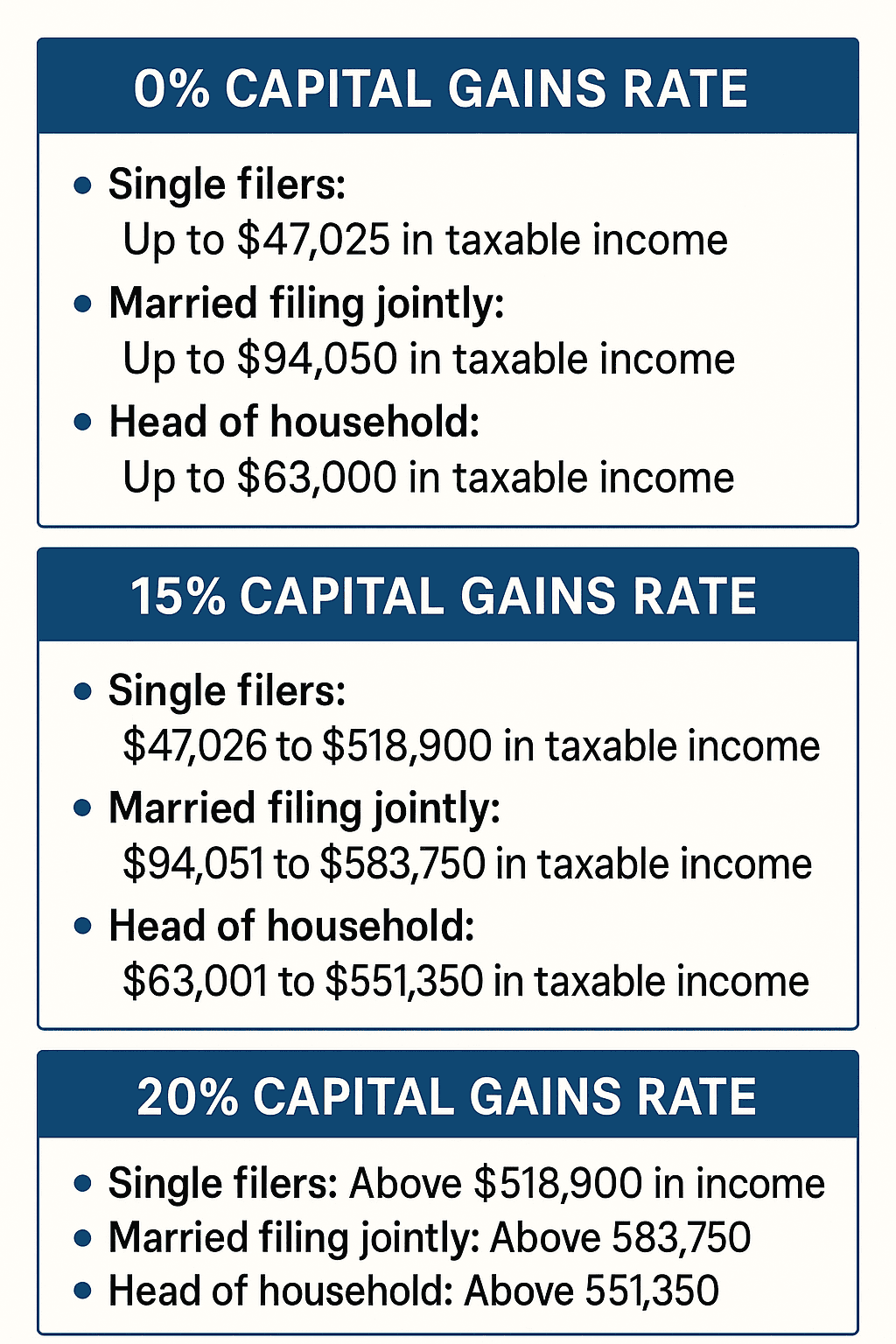

2025 Capital Gains Tax Brackets

The capital gains tax rates for 2025 are based on your total taxable income, including the capital gains themselves. Here’s how the brackets work:

Additionally, high-income earners may face an additional 3.8% Net Investment Income Tax on capital gains, bringing the top rate to 23.8%.

Strategic Planning Opportunities

Understanding these brackets opens up several tax-planning strategies you can implement before year-end:

Tax-Loss Harvesting: This involves selling investments that have lost value to offset gains from profitable investments. You can use up to $3,000 in net capital losses to offset ordinary income each year, and any excess losses can be carried forward to future years.

Managing Your Tax Bracket: If you’re close to moving into a higher capital gains bracket, you might consider spreading your gains across multiple years or timing other income to stay in a lower bracket.

Roth IRA Conversions: Years when you have capital losses might be ideal for Roth conversions, as the losses can offset the income generated by the conversion.

Common Capital Gains Mistakes

Many investors make costly errors when it comes to capital gains taxes:

Mistake 1: Not Tracking Your Cost Basis Your cost basis is what you originally paid for an investment, plus any reinvested dividends or additional purchases. Failing to track this accurately can result in overpaying taxes when you sell.

Mistake 2: Ignoring the Wash Sale Rule You can’t claim a tax loss if you buy the same or substantially identical security within 30 days before or after the sale. This rule can trap unwary investors who try to quickly repurchase stocks they’ve sold for tax losses.

Mistake 3: Selling Everything at Once Realizing large gains all in one year can push you into higher tax brackets. Consider spreading sales across multiple years to manage your tax impact.

Mistake 4: Not Considering State Taxes While we focus on federal capital gains rates, don’t forget that many states also tax capital gains as ordinary income. This can add significantly to your total tax bill.

Year-End Tax Planning Strategies

As we move through the second half of 2025, consider these strategies:

Review Your Portfolio for Tax-Loss Harvesting Opportunities Look for investments that are down from your purchase price. Selling these can offset gains you’ve already taken or might take before year-end. Remember to avoid the wash sale rule by not repurchasing the same investments within 30 days.

Consider Your Asset Location Hold tax-inefficient investments in tax-advantaged accounts like 401(k)s and IRAs, while keeping tax-efficient investments in taxable accounts. This strategy, called asset location, can reduce your overall tax bill.

Time Your Sales Strategically If you need to sell investments, consider the timing carefully. You might delay sales until January to push gains into the next tax year, or accelerate sales into December if you expect to be in a higher bracket next year.

Maximize Tax-Advantaged Account Contributions Contributing to 401(k), IRA, or other tax-advantaged accounts can reduce your current taxable income, potentially keeping you in a lower capital gains bracket.

Special Situations and Advanced Strategies

Qualified Small Business Stock (Section 1202) If you own stock in qualifying small businesses, you might be able to exclude up to $10 million or 10 times your basis in the stock from federal taxes when you sell. This is a powerful but complex tax benefit.

Installment Sales For very large gains, you might consider an installment sale, which spreads the gain over multiple years. This can help manage your tax brackets and potentially reduce your overall tax rate.

Charitable Giving Donating appreciated securities to charity allows you to avoid capital gains taxes while potentially getting a charitable deduction for the full fair market value.

Like-Kind Exchanges (1031 Exchanges) For real estate investors, 1031 exchanges allow you to defer capital gains taxes by reinvesting the proceeds in similar property.

Planning for Different Income Levels

Lower-Income Earners: Focus on maximizing use of the 0% capital gains bracket. Consider timing gains to stay within this favorable range.

Middle-Income Earners: You’re likely in the 15% capital gains bracket. Focus on tax-loss harvesting and managing the managing the timing of gains to avoid jumping to the 20% bracket is crucial for tax-efficient investing strategies. The key is understanding where you fall in the current tax year and making strategic decisions accordingly.

High-Income Earners: You’re likely facing the 20% rate plus potentially the 3.8% Net Investment Income Tax. Advanced strategies like charitable giving and installment sales become more valuable. Our independent financial advisors specialize in helping high-earners navigate these complex tax situations.

What Should I Do About Capital Gains?

Capital gains taxes don’t have to be a mystery or an unwelcome surprise. With proper planning and understanding of the tax brackets, you can make strategic decisions that minimize your tax burden while still achieving your investment goals.

The key is to start planning now, while you still have time to implement strategies before year-end. The decisions you make in the coming months about buying, selling, and managing your investments can have a lasting impact on your tax situation and your overall wealth.

Remember, the goal isn’t to avoid all taxes – it’s to pay your fair share while keeping as much of your investment returns as possible. Smart tax planning is just as important as smart investing when it comes to building long-term wealth.

About the Financial Planning Author

Alexander Langan, J.D, CFBS, serves as the Chief Investment Officer at Langan Financial Group. In this role, he manages investment portfolios, acts as a fiduciary for group retirement plans, and consults with clients regarding their financial goals, risk tolerance, and asset allocation.

With a focus on ERISA Law, Alex graduated cum laude from Widener Commonwealth Law School. He then clerked for the Supreme Court of Pennsylvania and worked in the Legal Office of the Pennsylvania Office of the Budget, where he assisted in directing and advising policy determinations on state and federal tax, administrative law, and contractual issues.

Alex is also passionate about giving back to the community, and has participated in The Foundation of Enhancing Communities’ Emerging Philanthropist Program, volunteers at his church, and serves as a board member of Samara: The Center of Individual & Family Growth. Outside of work and volunteering, Alex enjoys his time with his wife Sarah, and their three children, Rory, Patrick, and Ava.

About Langan Financial Group: Financial Advisors

Langan Financial Group is an award-winning financial planning firm with offices in York, Pennsylvania and Harrisburg, Pa.

With over 100+ 5-star reviews, Langan Financial Group is an independent financial planning firm established in 1985, offering a broad range of financial planning services.

With an open architecture platform, our advisors have access to a diverse range of products, free from any sales quotas.

Our team of 9 financial experts, each with unique specialties, enhances our ability to focus on delivering value to our clients.

Disclosure

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice.

Please consult legal or tax professionals for specific information regarding your individual situation.

The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC.

Investment Advisor Representative, Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Cambridge and Langan Financial Group, LLC are not affiliated.

Cambridge does not offer tax or legal advice.