Most people can tell you their salary, their mortgage balance, and how much they have in their 401(k). But ask them how much money they need to retire comfortably, and you’ll often get a blank stare or a vague answer about “a million dollars.” Without knowing your financial finish line, you’re essentially running a race without knowing where the finish line is located.

Your financial finish line is the specific amount of money you need to maintain your desired lifestyle without working. It’s not a round number you heard somewhere – it’s a personalized calculation based on your actual expenses, goals, and circumstances. And knowing this number is the difference between hoping you’ll have enough money and knowing you will.

Why Most People Don’t Know Their Number

Financial planning can feel overwhelming, so many people avoid it entirely. Others rely on rules of thumb like “you need $1 million to retire” or “save 10 times your salary.” While these guidelines can be helpful starting points, they don’t account for your specific situation.

Some people avoid calculating their finish line because they’re afraid of what they might discover. Maybe the number seems impossibly large, or maybe they’re worried they’re already behind. But here’s the truth: not knowing doesn’t change the reality of what you’ll need. It just makes it harder to create a financial plan to get there.

The good news is that once you know your number, you can work backward to create a realistic savings and investment strategy. You might discover you need less than you thought, or you might find out you need to make some adjustments. Either way, you’ll have a clear target to aim for.

The Components of Your Financial Finish Line

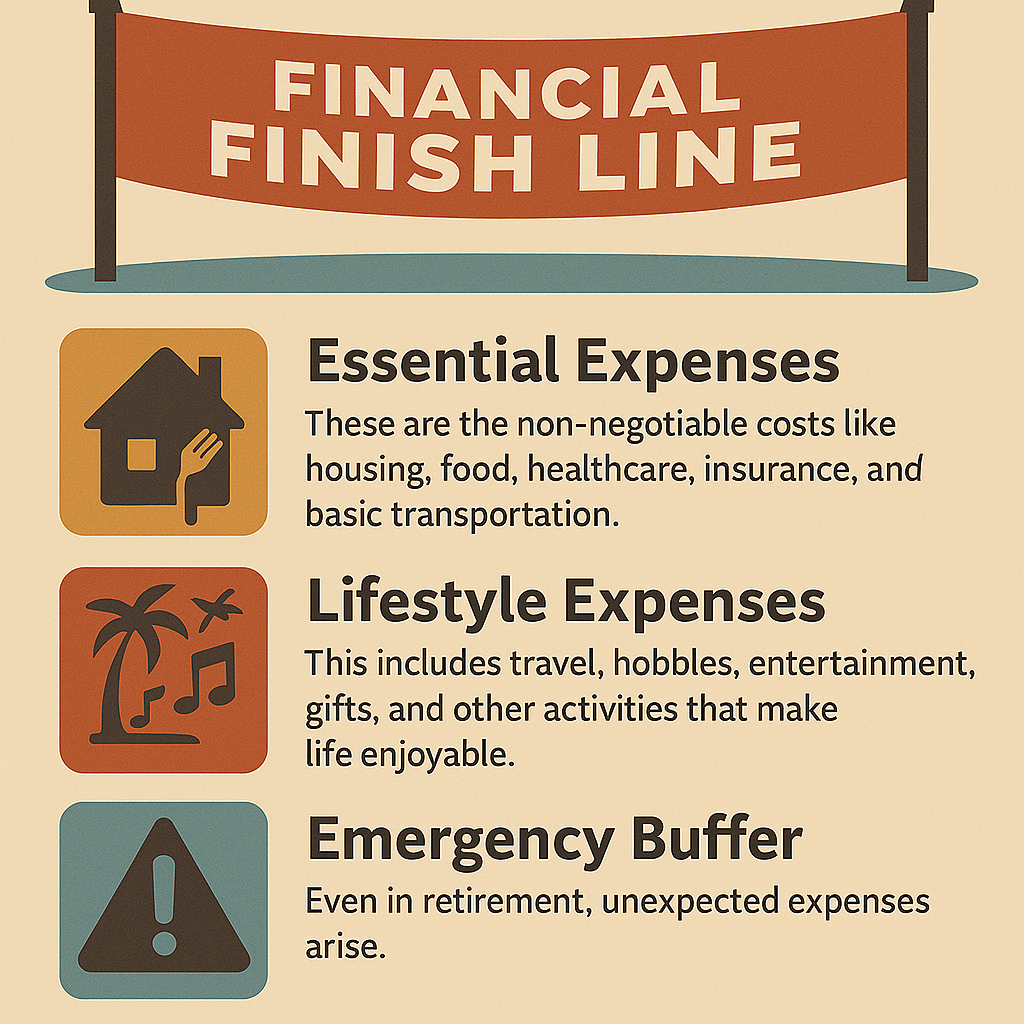

Your financial finish line isn’t just about covering basic expenses. It should account for the full picture of what you want your non-working years to look like:

Essential Expenses: These are the non-negotiable costs like housing, food, healthcare, insurance, and basic transportation. These expenses often decrease in retirement as mortgages are paid off and work-related costs disappear, but healthcare costs typically increase.

Lifestyle Expenses: This includes travel, hobbies, entertainment, gifts, and other activities that make life enjoyable. Don’t underestimate these – many people find they spend more on lifestyle activities in early retirement when they have more time and energy.

Emergency Buffer: Even in retirement, unexpected expenses arise. Home repairs, medical emergencies, or family situations can require significant cash. Your finish line should include a buffer for these situations.

Legacy Goals: If you want to leave money to children, grandchildren, or charities, this should be factored into your calculation. Some people want to spend their last dollar on their last day, while others want to leave a substantial inheritance.

The 4% Rule: A Starting Point, Not the Final Answer

Many financial advisors use the 4% rule as a starting point for retirement planning. This rule suggests that you can safely withdraw 4% of your portfolio value in the first year of retirement and adjust that amount for inflation each year afterward.

Using this rule, if you need $60,000 per year in retirement, you’d need $1.5 million saved ($60,000 ÷ 0.04 = $1,500,000). If you need $80,000 per year, you’d need $2 million.

The 4% rule is based on historical market performance and assumes a balanced portfolio of stocks and bonds. It’s designed to make your money last for 30 years of retirement, which covers most people’s needs.

However, the 4% rule has limitations. It was developed based on specific historical periods and may not account for current low interest rates, longer lifespans, or different market conditions. Some financial experts now suggest using 3% or 3.5% for a more conservative approach.

Calculating Your Personal Financial Finish Line

To determine your financial finish line, start by estimating your annual expenses in retirement. Here’s a step-by-step approach:

Step 1: Track Your Current Expenses Look at your spending over the past year. Categorize expenses into groups like housing, transportation, food, healthcare, entertainment, and miscellaneous. Many expenses will change in retirement, but this gives you a baseline.

Step 2: Adjust for Retirement Changes Some expenses will disappear (commuting costs, professional wardrobe, retirement plan contributions), while others might increase (healthcare, travel, hobbies). Be realistic about how your spending patterns might change.

Step 3: Account for Inflation If you’re planning to retire in 10-20 years, factor in inflation. Even at a modest 3% annual inflation rate, prices double every 23 years. What costs $60,000 today might cost $80,000 in 10 years.

Step 4: Consider Your Income Sources Subtract any guaranteed income you’ll receive in retirement, such as Social Security, pensions, or rental income. Your investment portfolio only needs to cover the gap between your expenses and guaranteed income.

Step 5: Apply Your Withdrawal Rate Take your net annual expenses (after subtracting guaranteed income) and divide by your chosen withdrawal rate. If you need $50,000 from investments and use a 4% withdrawal rate, you’d need $1.25 million.

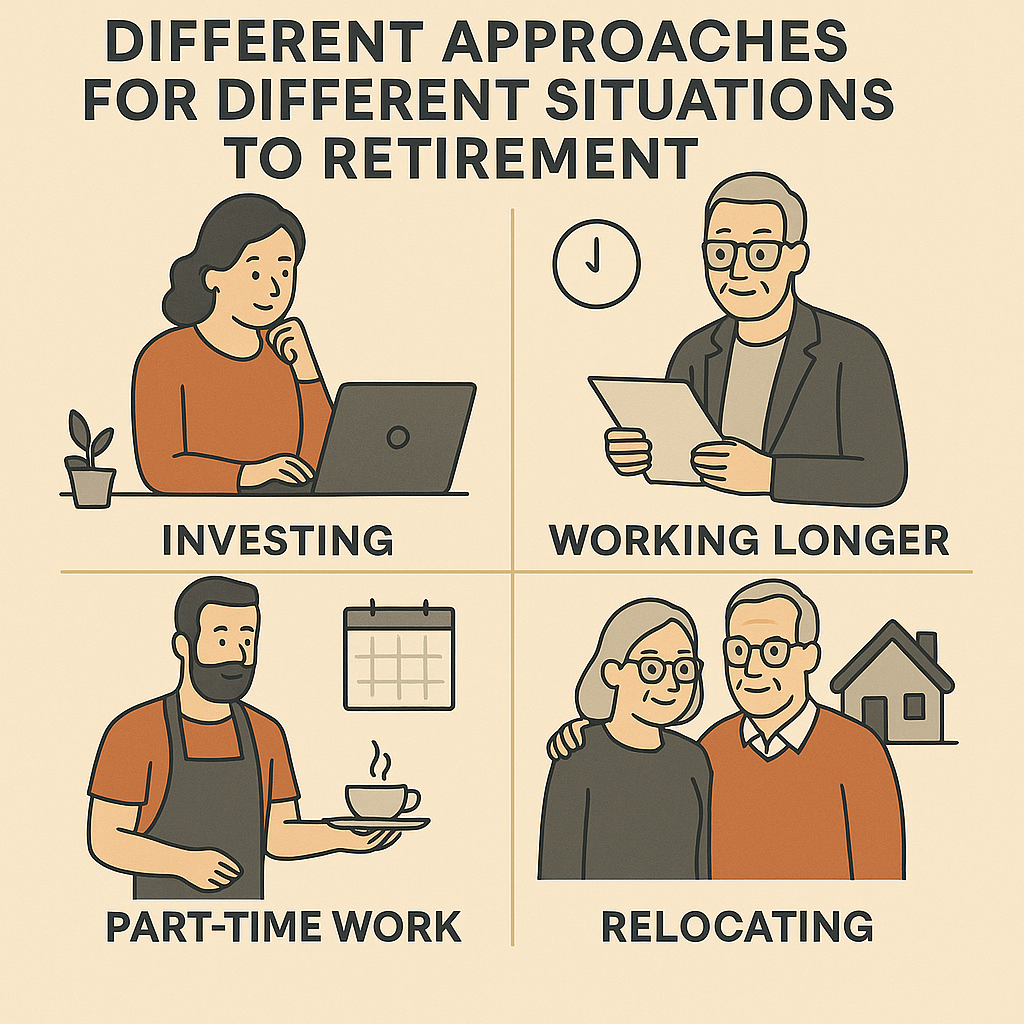

Different Approaches for Different Situations

Your financial finish line calculation might vary based on your specific circumstances:

Early Retirement: If you plan to retire before age 65, you’ll need to cover health insurance costs and won’t have access to Medicare or full Social Security benefits. This typically requires a larger portfolio.

Traditional Retirement: Retiring at 65-67 allows you to access Medicare and full Social Security benefits, reducing the burden on your investment portfolio.

Phased Retirement: Some people gradually reduce their working hours or take on part-time or consulting work. This can extend your working years and reduce the amount you need saved.

Geographic Arbitrage: Planning to move to a lower-cost area in retirement can significantly reduce your finish line number. However, factor in the costs of moving and being farther from family and familiar healthcare providers.

Beyond the Basic Calculation

Your financial finish line isn’t just about the total amount – it’s also about how that money is structured:

Tax Diversification: Having money in different types of accounts (traditional 401(k), Roth IRA, taxable investments) gives you flexibility in managing taxes during retirement. This is where tax-efficient investing strategies become crucial.

Liquidity Needs: Ensure you have adequate cash and short-term investments for immediate expenses and emergencies, separate from your long-term portfolio.

Healthcare Considerations: Healthcare costs are often the biggest unknown in retirement planning. Consider long-term care insurance or dedicating specific savings to healthcare expenses.

Common Mistakes in Calculating Your Finish Line

Underestimating Healthcare Costs: Healthcare expenses typically increase with age and can be substantial. Factor in premiums, deductibles, and potential long-term care needs.

Ignoring Taxes: Your retirement income will likely be taxable. Make sure your calculations account for the taxes you’ll owe on withdrawals from traditional retirement accounts.

Forgetting About Inflation: Over a 30-year retirement, inflation can significantly erode purchasing power. Make sure your plan accounts for rising costs over time.

Being Too Conservative or Too Aggressive: Some people save far more than they need out of fear, while others underestimate their needs. Try to find a balance that allows you to enjoy life today while preparing for tomorrow.

Adjusting Your Finish Line Over Time

Your financial finish line isn’t set in stone. It should be reviewed and adjusted regularly as your circumstances change:

Life Changes: Marriage, divorce, children, or changes in health can all affect your retirement needs.

Market Performance: Strong investment returns might allow you to retire earlier or with a higher lifestyle, while poor returns might require adjustments.

Expense Changes: Your actual retirement expenses might differ from your projections. Be prepared to adjust your spending or your portfolio withdrawals accordingly.

What to Do Once You Know Your Number

Once you’ve calculated your financial finish line, you can work backward to determine how much you need to save each month to reach your goal:

Use Online Calculators: Many websites offer retirement calculators that can help you determine monthly savings needs based on your current age, desired retirement age, and target amount.

Consider Professional Help: A financial planning team can help you create a comprehensive plan that accounts for taxes, insurance, estate planning, and investment allocation. Understanding how to choose the right financial advisor is essential for getting the guidance you need.

Automate Your Savings: Set up automatic transfers to retirement accounts to ensure you’re consistently working toward your goal.

Review and Adjust Regularly: Life changes, and so should your plan. Review your progress annually and make adjustments as needed.

The Psychology of Having a Target

Knowing your financial finish line does more than help with planning – it provides psychological benefits too. Having a specific target makes the abstract concept of “retirement” more concrete and achievable.

It also helps with current financial decisions. When you know you need to save $2,000 per month to reach your goal, it’s easier to evaluate whether that expensive vacation or new car purchase is worth delaying your retirement.

Some people find that calculating their finish line is motivating – they see it’s achievable with discipline and planning. Others might feel overwhelmed by the amount needed. If you fall into the latter category, remember that every dollar saved is progress, and there are ways to reduce your finish line through lifestyle adjustments or working a few extra years.

Ready to Calculate Your Financial Finish Line?

Your financial finish line is the most important number in your financial life. Take the time to calculate it, and then create a plan to cross it successfully.

Don’t leave your financial future to chance. Contact our experienced team today to start calculating your personal finish line and developing a comprehensive strategy to reach your retirement goals.

About the Financial Planning Author

Alexander Langan, J.D, CFBS, serves as the Chief Investment Officer at Langan Financial Group. In this role, he manages investment portfolios, acts as a fiduciary for group retirement plans, and consults with clients regarding their financial goals, risk tolerance, and asset allocation.

With a focus on ERISA Law, Alex graduated cum laude from Widener Commonwealth Law School. He then clerked for the Supreme Court of Pennsylvania and worked in the Legal Office of the Pennsylvania Office of the Budget, where he assisted in directing and advising policy determinations on state and federal tax, administrative law, and contractual issues.

Alex is also passionate about giving back to the community, and has participated in The Foundation of Enhancing Communities’ Emerging Philanthropist Program, volunteers at his church, and serves as a board member of Samara: The Center of Individual & Family Growth. Outside of work and volunteering, Alex enjoys his time with his wife Sarah, and their three children, Rory, Patrick, and Ava.

About Langan Financial Group: Financial Advisors

Langan Financial Group is an award-winning financial planning firm with offices in York, Pennsylvania and Harrisburg, Pa.

With over 100+ 5-star reviews, Langan Financial Group is an independent financial planning firm established in 1985, offering a broad range of financial planning services.

With an open architecture platform, our advisors have access to a diverse range of products, free from any sales quotas.

Our team of 9 financial experts, each with unique specialties, enhances our ability to focus on delivering value to our clients.

Disclosure

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice.

Please consult legal or tax professionals for specific information regarding your individual situation.

The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC.

Investment Advisor Representative, Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Cambridge and Langan Financial Group, LLC are not affiliated.

Cambridge does not offer tax or legal advice.