In the ever-changing world of group retirement plans, ensuring compliance with regulations set by the Internal Revenue Service (IRS) is essential in promoting the financial well-being of both the employer and employees. As the plan sponsor of a retirement plan, it is important to be proactive in identifying and addressing potential IRS red flags.

Understanding 401(K) Audit Red Flags

401(k) Red flags can result in triggering an audit or other scrutiny from the IRS. To be aware of potential issues, we have outlined the most common concerns, and their potential causes:

Red Flag #1: Out of Date Group Retirement Plan Documents

- Plan documents for the group retirement plan must be kept up to date with regulatory changes. This includes the adoption agreement, summary plan descriptions, and any amendments.

Red Flag #2: Overcontribution to the 401(k) Plan

- There are annual limits set for money a participant can save in a retirement plan. The 2024 401(k) contribution limits are:

| Pre-Tax or Roth Contribution | $23,000 |

| Catch-up (if over the age of 50) | $7,500 |

| Total Possible Contribution Limit: | $30,500 |

- 401(k) Contributions above the annual limit can result in penalties and taxation issues for both employees and employers. The plan sponsor must monitor the contributions to ensure it complies.

Red Flag #3: Incorrect Participant Eligibility Determinations

- Ensuring participants can enter the plan when they are eligible is imperative to the successful operation of a retirement plan. If there is an inaccurate eligibility entered, this can impact plan compliance.

Red Flag #4: Inadequate Monitoring of Loans and Distributions

- Loans and other distributions from group retirement plans are subject to specific rules and regulations. The failure to monitor these distributions can be a red flag to the IRS

- Non-compliance with loans or distributions can lead to tax consequences for both participants and the plan sponsors.

Red Flag #5: Inadequate Participant Communications

- Lack of clear communication for plan participants regarding plan rule changes and proper disclosures can raise red flags. Participants need to be well-informed and receive required notices within the time required by the IRS.

- Poor communication can lead to confusion, disputes, and potentially non-compliance. Plan sponsors must have effective communication channels and be aware of the associated deadlines.

401(k) Compliance and Documentation

A group retirement plan is governed by a group of documents collectively referred to as the “plan documents”. These documents were created at the establishment of the plan and include the Adoption Agreement, Summary Plan Description, Basic Plan Document, and Trustee Agreement, among others.

It is important to ensure these documents are always kept up to date, as every six years it is required to reinstate the documents to the IRS.

Group Retirement Plan Communication with Plan Participants

There should be strong communications in place for the 401(k) plan participants, as they need to be aware of the:

- features

- rules

- any changes in the retirement plan

Possible changes that may happen can include:

- plan eligibility

- contribution limits

- vesting schedules

To effectively communicate with plan participants, organizations should consider using multiple means such as newsletters, e-mail updates, information seminars, and online portals.

With some mediums being more effective than others, it is important to discuss with your employee base what method they find most effective.

Education meetings are one form of communication with plan participants that can have a strong association with participation in the retirement plan. Education meetings should be scheduled at least once a year to ensure participants are up to date with any changes to the retirement plan landscape.

An education meeting is an opportunity for participants to ask questions and receive answers. They can receive updates on any plan or industry changes or learn how the plan can impact their retirement.

If a plan decides to replace investments or change service providers, a communication plan would need to be implemented, alerting the employees. These changes require a 30–60-day notification to plan participants so they can make any applicable changes before the deadline.

By focusing on clear communication and participant education, plan sponsors can significantly reduce the risk of IRS red flags in plan 401(k)s. Informed participants are more likely to follow the rules of the plan, report discrepancies, and contribute to the overall compliance of the group retirement plan. Regular communication can create a positive relationship between plan sponsors and participants, promoting a culture of compliance and transparency.

Monitoring 401(k) Contributions and Distributions

401(k) plan can be either bundled or unbundled. The status of “bundled” depends on who is doing the administration of the plan. For a bundled plan, it will be administered by the recordkeeper and their internal administration team. An unbundled plan would use a recordkeeper, and a Third-Party Administrator (TPA) for the administration of the plan.

For an unbundled 401(k) plan, the Third-Party Administrator (TPA) will likely handle a lot of the administration around contributions and distributions. With this, the TPA should conduct annual testing and verification that contributions are being processed correctly. This testing and review include payroll data, employee deferrals, and employer contributions. Any discrepancies should be promptly addressed and corrected.

Leveraging automation and integrated systems can help to reduce the risk of manual errors in the contribution process. By working with the recordkeeper and your company payroll provider, you can set automated payroll integrations so that if a participant changes deferral amounts on the 401(k) website, it will automatically change at the payroll company. Payroll integrations can be very helpful in reducing manual data entry errors.

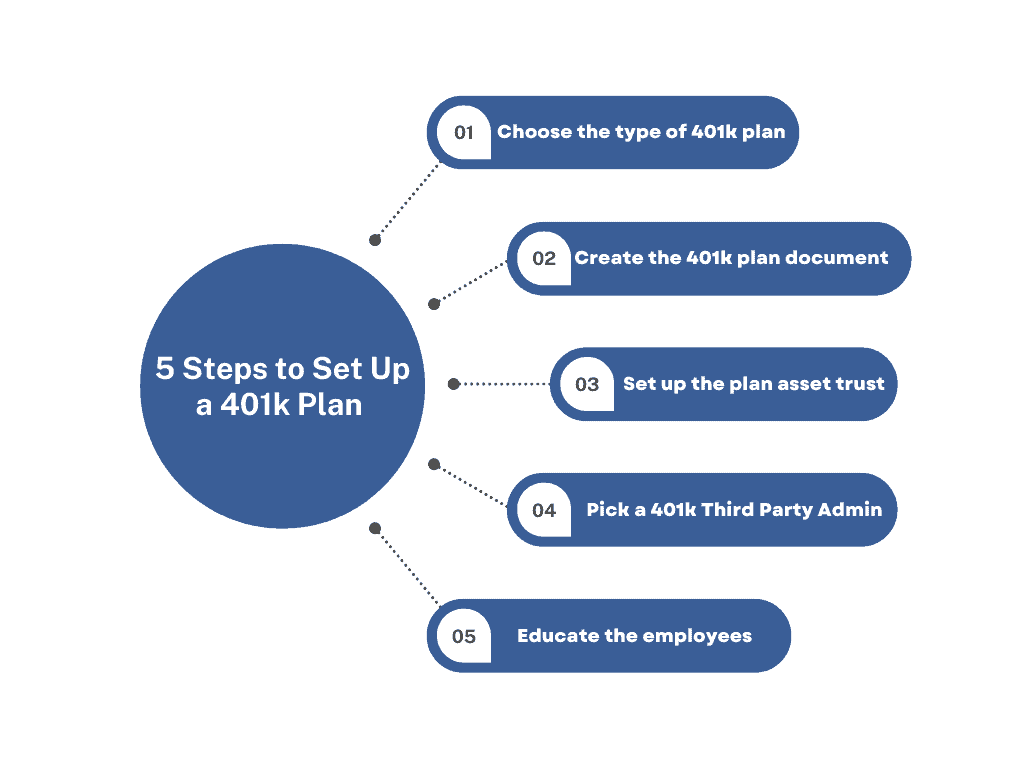

How to Fix a 401k? Work with Qualified 401(k) Advisors

Having a team of well-experienced partners when sponsoring a retirement plan is paramount to the effectiveness of the plan. If you’re struggling to fix a 401(k) that is not in compliance, or if you’re searching for help setting up a group 401(k) – our team of advisors can help.

Continuous education for plan administrators can be provided by the 401(k) advisor. Staying up to date on tax law, compliance requirements, and changes in the retirement plan landscape can be particularly difficult without guided lessons.

By using a financial advisor for investment oversight, you can ensure the investment options align with the best interests of the plan participants. An advisor should review the investment options quarterly at a minimum so they can address any deficiencies in the investment lineup.

Using a Third-Party Administrator can add an additional layer of protection for the plan sponsor. The TPA will oversee day-to-day plan administration, year-end testing, and compliance. It is important to review the services agreed upon by the TPA and plan sponsor to make sure they are completing all of the services in the agreement.

Staying Informed of Group Retirement Plan Regulatory Changes

With the ever-developing group retirement plan landscape, staying up to date with industry changes is essential. The financial advisor and Third-Party Administrators should provide updates to the plan sponsor detailing any changes or updates in the law. In addition to the resources shared by the retirement plans service team, some newsletters can be used to get up-to-date changes.

Best Practices for 401(k) Plan Sponsors

When sponsoring a group retirement plan, these are a few recommended best practices:

- Segregation of Group Retirement Plan Duties

- By having different team members in charge of different tasks, the plan can be managed more efficiently. This would include having somebody designated as a payroll contact and somebody designated as a plan sponsor, handling enrollments, and other participant changes. This in hand with your service team (advisor, TPA, and recordkeeper) should mitigate red flags.

- Ongoing Group Retirement Plan Education Programs

- Offering continuous education for plan administrators can help them stay engaged and well informed. This includes topics such as regulatory changes, fiduciary responsibilities, and effective plan management.

- Regular 401(k) Plan Reviews

- Regularly review plan documents, procedures, participation, and other measures of plan performance with the financial advisor. This will ensure the plan sponsor is aware of the current state of the plan and can engage in various campaigns to improve the effectiveness of the plan.

- Addressing 401(k) issues & plan discrepancies promptly

- With a proper team in place, and plan sponsors up to date on the state of the plan, addressing any discrepancies can be completed promptly resulting in a quick resolution.

About the Authors

Alexander Langan, J.D, CFBS, serves as a Financial Advisor at Langan Financial Group. In this role, he manages investment portfolios, acts as a fiduciary for group retirement plans, and consults with clients regarding their financial goals, risk tolerance, and asset allocation.

With a focus on ERISA Law, Alex graduated cum laude from Widener Commonwealth Law School. He then clerked for the Supreme Court of Pennsylvania and worked in the Legal Office of the Pennsylvania Office of the Budget, where he assisted in directing and advising policy determinations on state and federal tax, administrative law, and contractual issues.

Alex is also passionate about giving back to the community and has participated in The Foundation of Enhancing Communities’ Emerging Philanthropist Program, volunteers at his church, and serves as a board member of Samara: The Center of Individual & Family Growth. Outside of work and volunteering, Alex enjoys his time with his wife Sarah, and their three children, Rory, Patrick, and Ava.

Harry Claypool currently serves as an Associate 401(k) Advisor at Langan Financial Group where he assists Alex in servicing retirement plans, preparing plan reviews, and handling administrative work. In his free time, Harry enjoys visiting new restaurants, spending time with friends and family, and watching the Eagles.

About Langan Financial Group

Langan Financial Group, based outside of Harrisburg and York Pennsylvania. It is an independent financial planning firm established in 1985, offering a broad range of financial planning services. With an open architecture platform, our advisors have access to a diverse range of products, free from any sales quotas. Our team of 9 financial experts, each with unique specialties, enhances our ability to focus on delivering value to our clients.

Disclosure

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC.

Investment Advisor Representative, Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Cambridge and Langan Financial Group, LLC are not affiliated.

Cambridge does not offer tax or legal advice.