Investment Planning Guide

Answering investment planning FAQs and helping you identify the right investment advisor

Investment Planning Testimonials

My investments have done well. I have full confidence in this group. My family now invests with them. They have gone beyond the call of duty in caring for my family.

They didn't know this: When my husband died, I had an outside advisor review my investments.

His advice? Stay with success.

My husband and I, in addition to three other family members, have been advised financially by Bob and team for years.

We've always experienced friendliness, professionalism, and compassion when dealing with the Langan Financial Group.

They continue to advise us in maintaining a balanced and profitable portfolio.

Investment Planning

Investment planning can be a time consuming process when you take into consideration an individual's unique situation, investment goals, and the overwhelming amount of options.

Below, we will help explain:

- What is an investment advisor

- How to choose an investment advisor

- How to find an investment advisor

- What is the investment planning process

When deciding to create an investment plan, it is vital you work with an investment manager who is not limited to cookie cutter solutions or a few investment products.

You do not want to be a number stuffed into a plan that was not designed with your specific needs in mind.

You want an investment advisor that understands investment planning concepts and utilizing best practices to create a customized strategic plan to help you achieve your investment goals.

What Does an

Investment Advisor Do?

An investment advisor, also known as an investment manager, is a compensated individual who makes investment recommendations or conducts securities analysis for a person.

To do this, the individual must be registered with the Securities and Exchange Commission or the State regulator.

Investment advisors manage a client or organization's assets and can help with conducting trades on behalf of the individual.

This includes:

- Building an investment portfolio

- Tracking investment fund performances

- Selling and purchasing investments

How to Choose a Registered Investment Advisor

Each investment advisor is register with the Securities and Exchange Commission. You can view an advisor's background through BrokerCheck on FINRA's website, another organization who oversees registered investment advisors.

Here, BrokerCheck will tell you if the firm or person is registered as required by law, to sell securities or offer investment advice or both.

BrokerCheck is a free tool that allows for clients and potential clients to conduct a background check on:

- Brokers

- Brokerage firms

- Investment advisor firms

- Investment advisors

BrokerCheck allows you to view the following information for an investment manager:

- Activity

- Employment history

- Regulatory actions

- Investment related licensing

- Any arbitrations or complaints

How to Find An

Investment Advisor

In finding any investment advisor near you, it is important to understand the financial firm and person you are looking to work with.

Consider learning about current client experiences through anyone who has used their services.

In addition look for reviews on Google or other platforms to see how most people's experiences are going.

Finally, you can view BrokerCheck to understand an advisor's history, any arbitration or regulatory issues as well.

Investing Planning Process

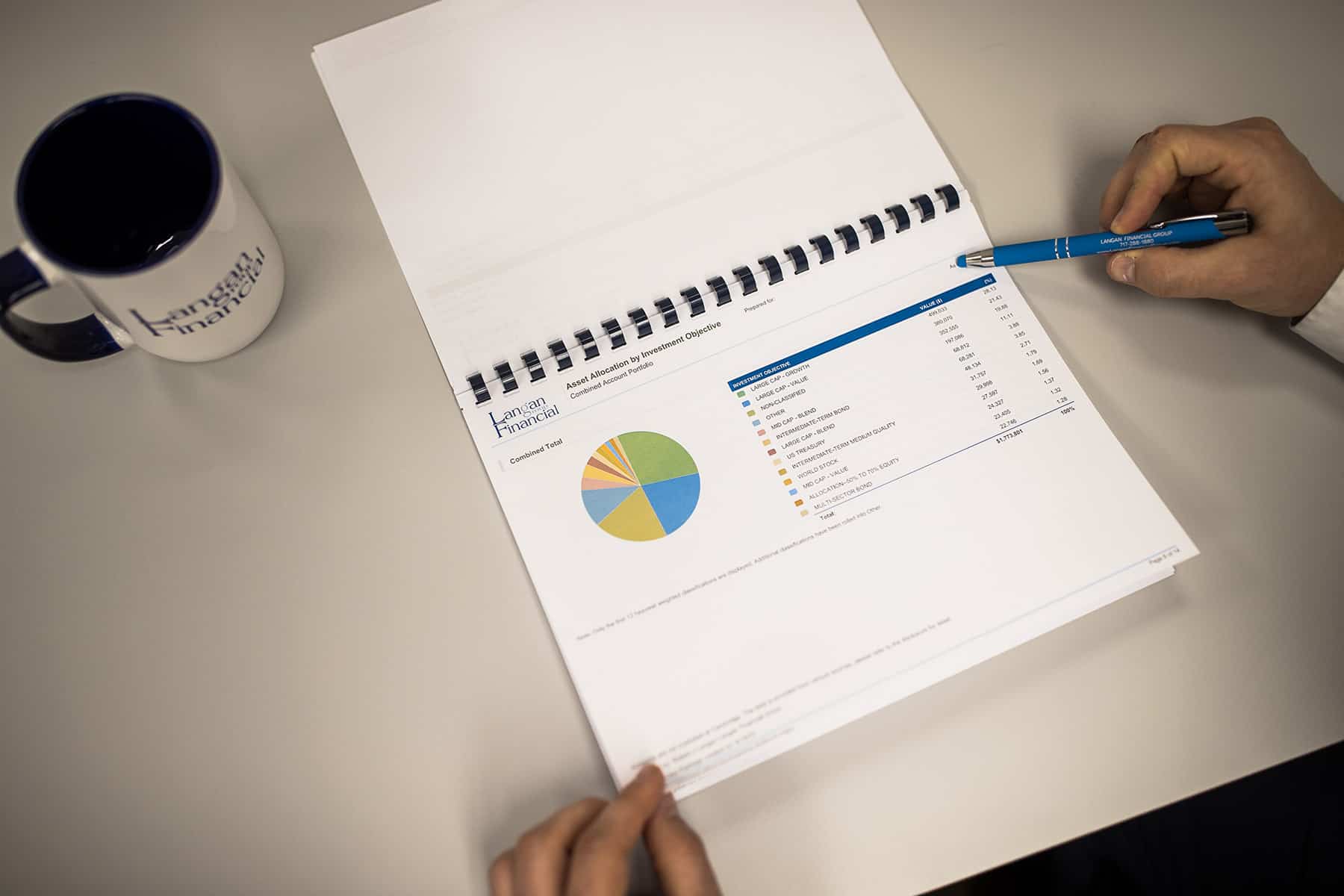

Langan Financial Group takes a holistic approach to your investment needs. We focus on aligning your tactics with your financials goals so no part of your financial plan is working against you.

We strive to collaboratively create low cost, diversified portfolios that can be either active management or passive management according to your personal and financial risk tolerance.

We will collaborate with you to structure your portfolios to target either build wealth or for retirement income planning.

Start Investment Planning

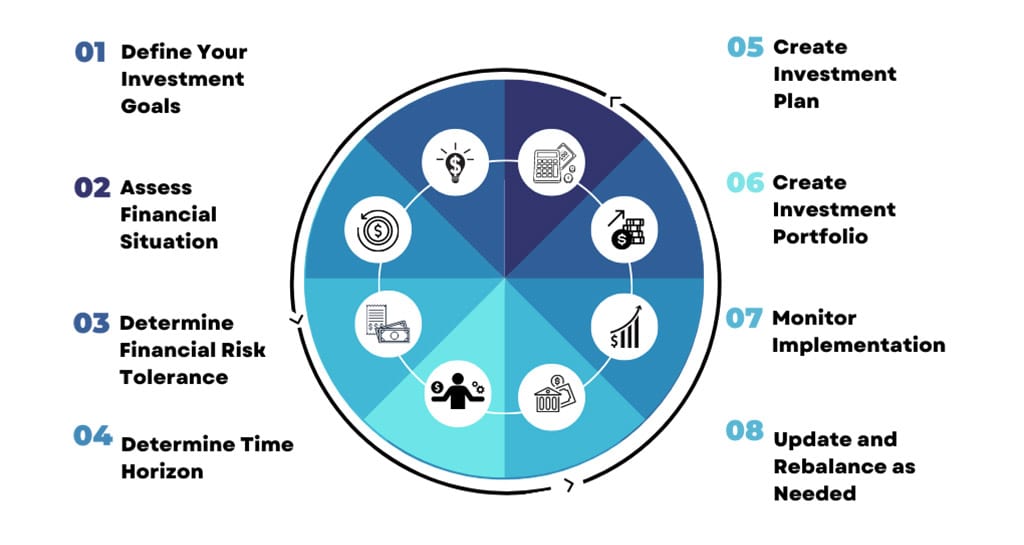

1. Define Your Investment Goals

Defining your goals is vital to understanding where you want to be. If we do not know what your goals are, we can not create a plan to get you there.

By understanding your investment goals, we can align all the financial tactics together to more efficiently reach your objectives. We want to overcome your financial obstacles, not create more.

2. Assess Financial Situation

Assessing your financial situation allows us to create a Financial Gap Analysis.

This analyzes the difference between your current financial situation is from your investment goals. This includes looking at your current tax bracket to determine if there are any options for tax saving investments. We can also help with inheritance tax planning needs.

Our comprehensive financial dive allows us to start working backwards to identify the financial tactics and steps needed to achieve your objectives.

3. Determine Financial Risk Tolerance

Now that we have the Financial Gap Analysis created, we need to start working on the financial tactics.

Depending on your financial risk tolerance will determine how aggressive or conservative we will be in setting up your plan. This will directly impact the tactics used as well as the investment funds available within the portfolio.

4. Determine Time Horizon

Understanding when you would like to achieve your financial goals is imperative in creating your plan.

If you are 20 years old starting to invest for retirement for age 65 or you are looking to use the investments to purchase a house in 10 years, your tactics will change greatly.

Determining your time horizon will be combined with your risk tolerance to ensure every step is aligned with your comfort.

5. Create Investment Plan

Now that the Financial Gap Analysis is created with you risk tolerance and time horizon, we will work backwards from your goals to create your investment strategy.

This customized financial plan will break down the step by step financial tactics needed to help you achieve your goals within your time frame.

6. Create Investment Portfolio

Within the plan will host a customized investment portfolio for you. It is vital all of these components are aligned and working together towards your plan within your investment portfolio.

If these characteristics are not working together, it is possible portions of your plan will inhibit each other.

This will create unnecessary financial obstacles within your plan, making it even more difficult to achieve your investment goals.

7. Monitor Implementation

The next vital part is monitoring the implementation. We utilize a proprietary Financial Early Warning System.

A Financial Early Warning System is a customized system according to your investment plan that alerts us when issues are starting to rise. We take a proactive approach and try to capture any potential issues as early as possible.

8. Update and Rebalance as Needed

Once issues are identified by the Financial Early Warning System, we revisit the investment plan to determine how the red flags will impact your strategy.

We alert our clients to the issues and provide suggested tactical changes. We focus on a proactive approach, doing our utmost best to ensure our clients' financial needs are taken care of.

We do not want to wait for something to happen and have to react to a bad scenario. Rather we prefer to monitor key signs alerting us any upcoming potential issues.

Chat with a Registered Investment Advisor

If you have any financial planning questions or concerns, please feel free to contact us for a free consultation.

You can reach us at 717-288-1880 or visit our contact us page to send an inquiry. We will be sure to respond within 24 hours.

FREE Benchmark Comparison Services

Financial Advisor Locations:

Camp Hill, PA Financial Planning Office

York, Pa Financial Planning Office

Harrisburg, PA Financial Planners

Communities Served:

Disclosure: Check the background of your financial professional on FINRA's BrokerCheck. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Cambridge and Langan Financial Group, LLC. are not affiliated. Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, to residents of: AL, AZ, CO, DE, FL, GA, KY, MD, NJ, NM, NY, NC, OH, PA, RI, TX, VA Cambridge and Langan Financial Group does not offer legal advice. Estate planning services are in regards to your overall financial plan. Always be sure to speak to a legal professional in regards to specific legal matters. Fixed insurance services offered through Langan Financial Group. https://www.joincambridge.com/investors/cambridge-disclosures/form-crs/

Testimonial/Endorsement Disclosure: The testimonials may not be representative of the experience of other customers. The testimonials are no guarantee of future performance or success. All of the testimonials/endorsements are clients with the exception of Steven Martinez of York SPCA. There was no cash nor non-cash compensation for any of the testimonials provided.

© Langan Financial Group

Harrisburg, PA Office

Address: 1863 Center St, Camp Hill, Pa 17011

Phone: 717-288-1880

York, PA Office

Address: 3405 Board Rd, Suite 200, York, Pa 17406

Phone: 717-773-4085