Guide to Portfolio Management

Portfolio Management Testimonials

Our Senior Living Foundation has been with Bob and his team for over 5 years.

The Board of Directors is impressed with the integrity, and guidance of the LFG staff.

We know, without a doubt, they have our best interests at heart.

Executive Director, Polk Foundation

The Langan Financial Group has been both outstanding and extremely helpful for our organization.

The entire office staff is friendly and easy to work with. They have a level of caring that large brokerage firms cannot approximate.

In many ways the old adage applies here , you don’t care how someone knows until you know much how much they care.

I’m certain they have many clients who bring much larger investment portfolio into the firm but they have a way of making us little guys feel just as important to them.

President, Millersburg Ferry Boat Association

What is Portfolio Management?

Portfolio management is creating, monitoring, and adjusting a selection of investments for an organization's financial goals.

The ultimate goal is to maximize the portfolio investment's expected return within an appropriate level of risk exposure. To properly manage a portfolio, an advisor must:

- Fully understand the needs of a client

- Draft an Investment Policy Statement (IPS)

- Regularly monitor the investments of a portfolio

Types of Portfolio Management

There are three main types of portfolio management:

- Endowment Funds

- Foundation Funds

- Business Account also known as a corporate account

These types are typically used by:

- Businesses

- Non-profits

- Government Entities

What is an Endowment Fund Portfolio?

An endowment is a donation to a non-profit that can be used for investment income purposes.

They are designed to maintain the principal amount while using the investment income to support their missions.

These donations can be given through:

- Planned Giving which refers to donations from estate or legacy planning

- Property

- Money

Four Types of Endowment Funds:

Restricted endowment

A restricted endowment does not allow the principal to be spent and the investment income can only be used according to the donor's specified wishes.

Unrestricted endowment

An unrestricted endowment has little to no restrictions and can be spent according to the organization's wishes.

Term endowment

A Term endowment is designed as a temporary fund. Both the principal and investment income are spent over the years to completion.

Quasi-endowment

A quasi-endowment is established and funded by the institution. The board of directors is able to oversee how the funds are spent and can change the restrictions according to their wishes.

What is a Foundation Fund Portfolio?

A foundation fund portfolio is very similar to an endowment, designed for similar purposes.

The main differences are:

- A foundation, also known as a charitable foundation, can be considered a separate legal entity

- A foundation can use its funds for multiple purposes unlike a restricted endowment

What is a Business Account Portfolio?

A business account portfolio, also known as a corporate account, is a company's investment funds.

The portfolio should align the company's strategy. with its financial and investment goals. In order to maximize the portfolio's investment, it should take into consideration:

- Market trends

- Timeframe

- Budgetary restrictions

- Risk tolerance

- Diversification

Key Features of Good Portfolio Management?

There are four major features when it comes to good portfolio management practices:

- Understanding the Investment Needs

- Creating an Investment Policy Statement

- Proper fiduciary protection

- Monitoring the portfolio properly

Portfolio Investment Needs

When engaging with a client, it is essential to have all of the relevant information about their organization to make the best impact on their portfolio.

To build a proper portfolio, it is vital to understand:

- What are your goals?

- What funds are available to invest?

- What is your timeframe?

- What is your risk tolerance?

Once an advisor has a clear picture of their situation, goals, and investment needs, they are able to draft an Investment Policy Statement.

However, once these items are identified, it is vital to continually meet with the client to review the portfolio's performance as well as the client's goals.

As time progresses, the goals may change, thus impacting the overall portfolio strategy.

Investment Policy Statement (IPS)

An Investment Policy Statement is a document created to govern investment decision-making after understanding the needs of a client.

It is not a legally required document, rather, it is a document that outlines investment guidance, allowing the portfolio advisor to act on behalf of the client within general rules.

This document gives written approval within set limitations of what the advisor can and cannot do on behalf of the client.

The document is drafted by the investment advisor and the client to describe the strategies employed to meet investment objectives.

It is important to have an IPS because if the portfolio manager has any questions about suitability, they can refer back to the IPS to see if the portfolio investment strategies are a strong fit.

The Investment Policy Statement should define the following core objectives:

- The plans investment philosophy and objectives

- Who is responsible for selecting and monitoring investments

- How the plan forms an investment menu

- How the plan will benchmark investments

- What will cause the plan to change investments and how the process will be managed

Once the IPS is completed and discussed with the client, it should be signed and reviewed annually to ensure it is still accurate.

Portfolio Management Fiduciary Protection

Proper fiduciary protection is vital for any organization investing assets.

If proper policies and procedures are not put in place or followed, an organization could be personally liable for imprudent investment choices.

As such, setting up fiduciary protection correctly can minimize your risk and liabilities.

Portfolio Monitoring

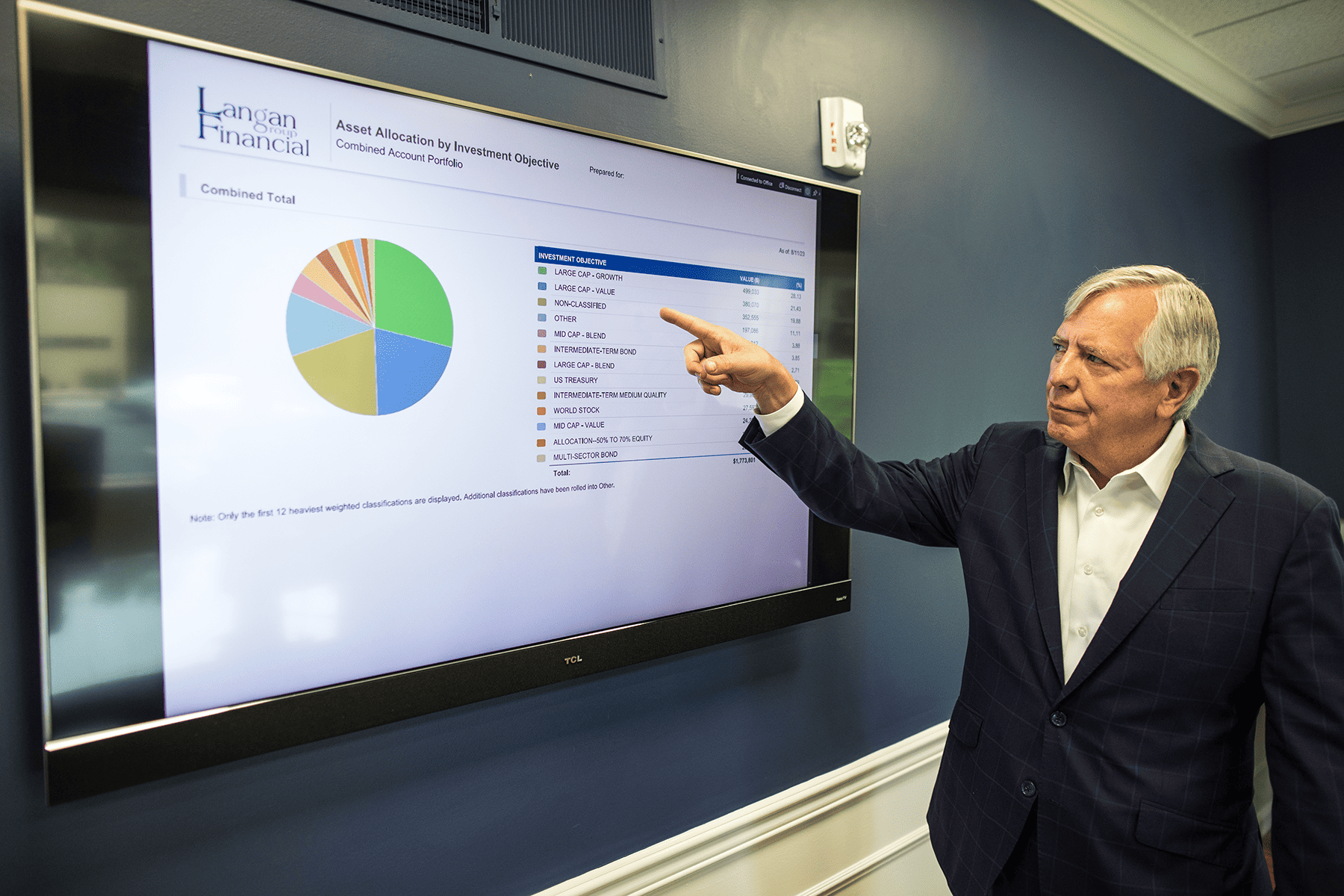

While monitoring a portfolio, a portfolio manager will take several criteria into consideration when evaluating a portfolio's performance toward your financial goals:

- Risk Assessment

- Asset Allocation

- Diversification

- Investment Performance

The advisor should alert the organization when funds start showing red flags, alerting changes that may need to be made, and provide potential alternatives available.

Portfolio Risk Assessment

It is vital that asset allocation and diversification are reflective of your risk tolerance.

Depending on your risk tolerance will directly impact how the portfolio's investments are allocated and diversified.

A portfolio that is extremely conservative versus one that is extremely risky will have completely different funds within them.

If the portfolio is not properly allocated, you could be at risk of losing your investments.

Portfolio Asset Allocation

The three most common asset allocations are stocks, bonds, and cash.

It is important for a portfolio manager to choose the proper weights of each allocation.

By reviewing the Investment Policy Statement and ongoing discussion with the client an advisor can determine what the proper allocation weights are.

Portfolio Diversification

Diversification is the practice of owning multiple assets that are not closely correlated with each other.

This is to prevent the entire portfolio from going down if a few of the assets do not perform well.

When done well, diversification could increase a portfolio's overall expected return while minimizing risk.

Our Portfolio Investment Management Services

We strive to be the best financial business advisors possible. You can view our BrokerCheck to see our employment history, our zero regulatory issues, and zero arbitration issues.

In addition, you can view our over 75 - 5 star reviews on Google reviews.

We are highly flexible with your schedule. While our standard hours are 8:00 am to 5:00 pm, we are available evenings and weekends by appointment to help cater to your schedule.

Get a Free Portfolio Evaluation from a Portfolio Manager

If you have any financial planning questions or concerns, please feel free to contact us for a free consultation.

You can reach us at 717-288-1880 or visit our contact us page to send an inquiry. We will be sure to respond within 24 hours.

FREE Benchmark Comparison Services

Financial Advisor Locations:

Camp Hill, PA Financial Planning Office

York, Pa Financial Planning Office

Harrisburg, PA Financial Planners

Communities Served:

Disclosure: Check the background of your financial professional on FINRA's BrokerCheck. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Cambridge and Langan Financial Group, LLC. are not affiliated. Cambridge Investment Research Advisors, Inc. a Registered Investment Advisor. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, to residents of: AL, AZ, CO, DE, FL, GA, KY, MD, NJ, NM, NY, NC, OH, PA, RI, TX, VA Cambridge and Langan Financial Group does not offer legal advice. Estate planning services are in regards to your overall financial plan. Always be sure to speak to a legal professional in regards to specific legal matters. Fixed insurance services offered through Langan Financial Group. https://www.joincambridge.com/investors/cambridge-disclosures/form-crs/

Testimonial/Endorsement Disclosure: The testimonials may not be representative of the experience of other customers. The testimonials are no guarantee of future performance or success. All of the testimonials/endorsements are clients with the exception of Steven Martinez of York SPCA. There was no cash nor non-cash compensation for any of the testimonials provided.

© Langan Financial Group

Harrisburg, PA Office

Address: 1863 Center St, Camp Hill, Pa 17011

Phone: 717-288-1880

York, PA Office

Address: 3405 Board Rd, Suite 200, York, Pa 17406

Phone: 717-773-4085