February 10, 2026

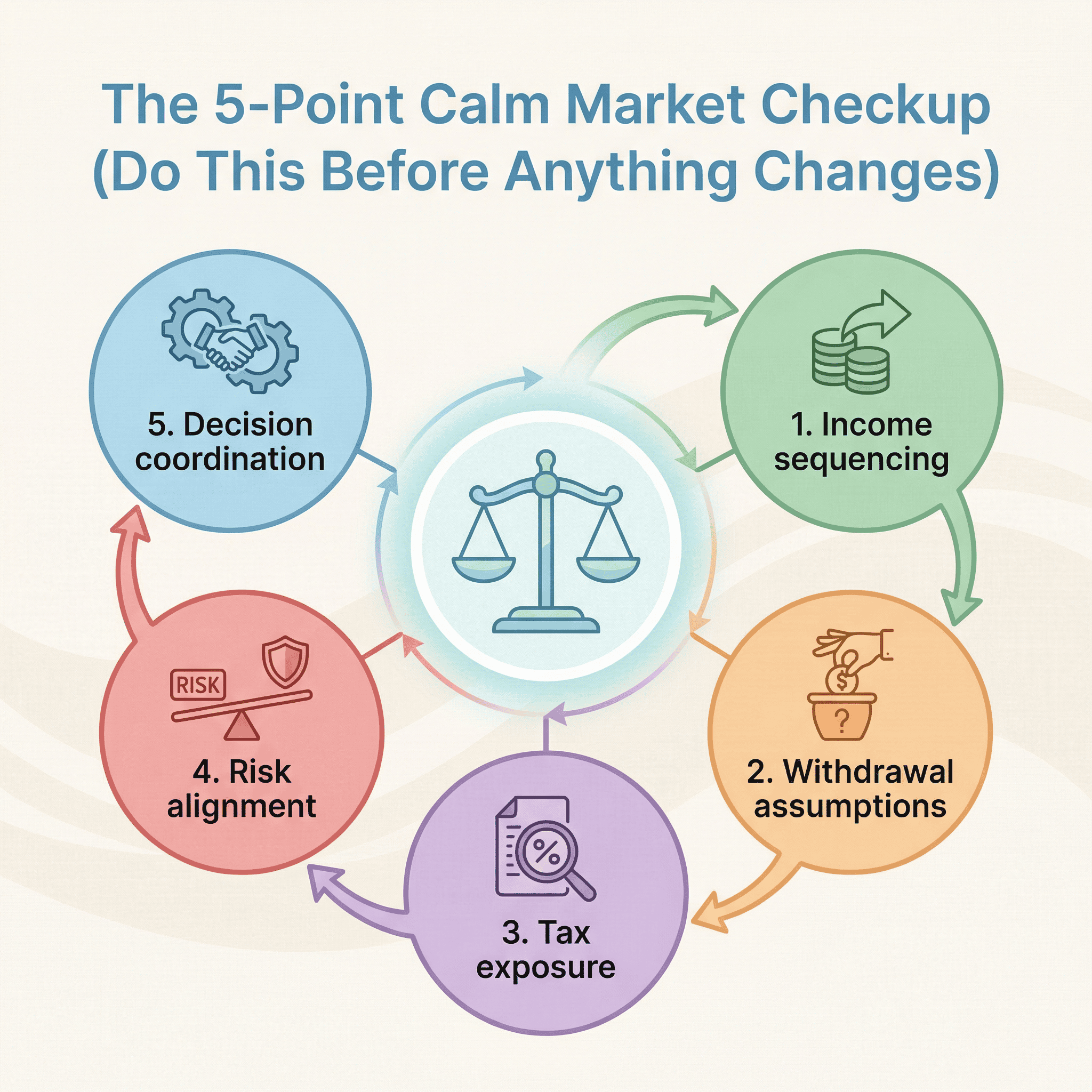

Why Calm Markets Are the Best Time to Strengthen a Retirement Plan

Nobody calls their advisor when things are going well. Markets are steady. Statements look fine. Nothing hurts. So they do nothing. And that’s exactly when the most valuable planning work can happen — but almost nobody does it. Here’s the problem: by the time something forces you to look at your plan, your options have already shrunk. You’re reacting. You’re...

February 10, 2026

A Simple Way to Tell If Your Plan Is Too Dependent on Market Timing

They did everything right. Saved consistently for thirty years. Stayed diversified. Didn’t panic during 2008 or 2020. Retired at 63 with a solid portfolio and a plan that looked great on paper. Then markets dropped 18% in their first year of retirement. Not a catastrophe—but enough that their $7,500 monthly withdrawals started eating into a shrinking base. By the time...

January 27, 2026

Why a Quiet Crisis in Japan’s Bond Market Could Shake Your Retirement Plans—And What You Can Do Now

How global bond shifts may be silently impacting your retirement security (and how to protect yourself) Tom and Susan Thought They Were Ready to Retire They’d saved for thirty years, built what looked like a solid nest egg, and even booked a celebratory cruise to Alaska. But during what should have been a routine check-in with their advisor, one quiet...

October 12, 2025

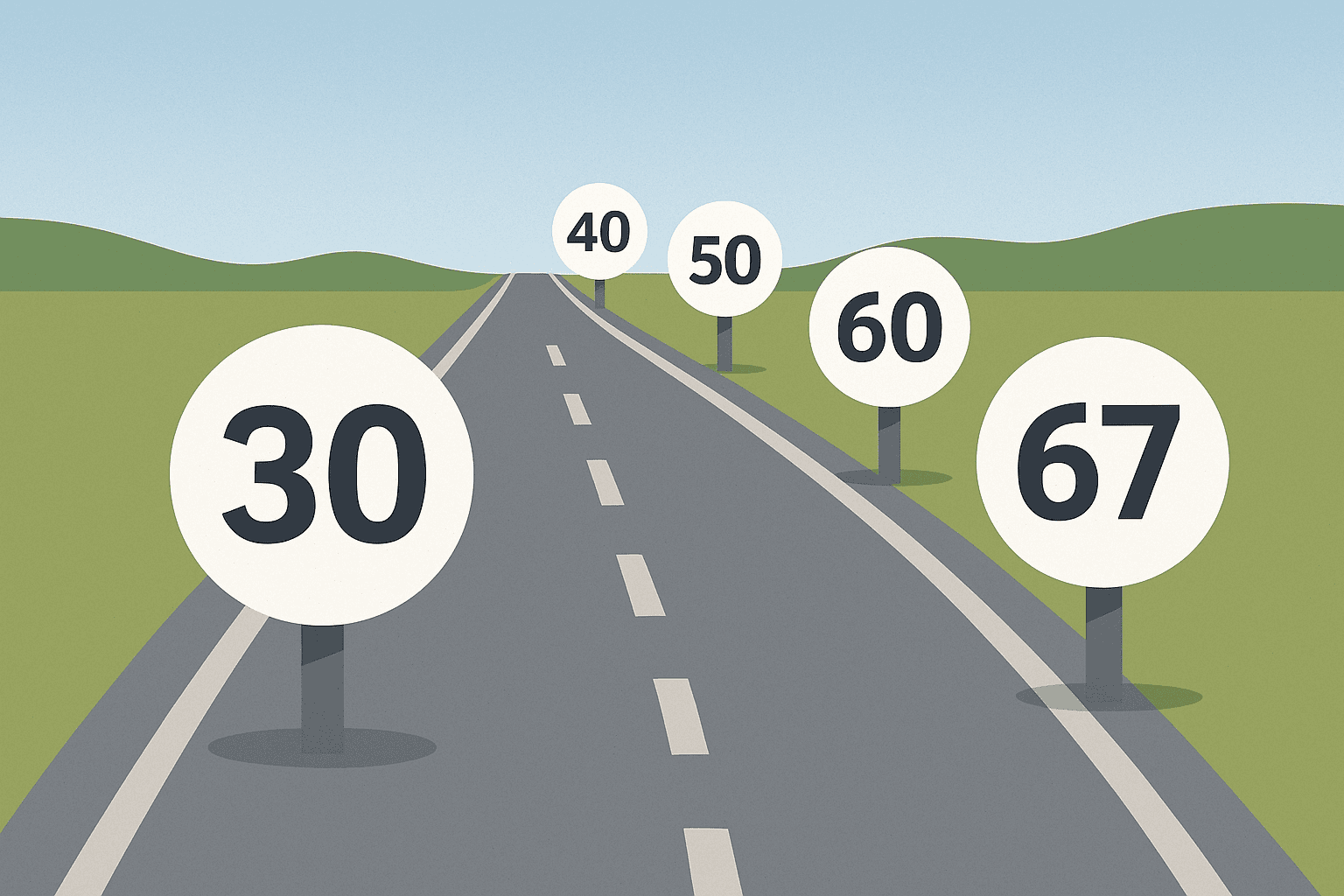

How Much Should I Have Saved in My 401(k) at Key Ages?

Many people wonder, “Am I on track with my 401(k)?” Having a few checkpoints can help you see where you stand — and what small changes can make a big difference. 401(k) Benchmarks: What Experts Suggest Financial planners often use income multiples as targets: Age Suggested Savings Target Why It Helps 30 1× your annual pay Get your footing early...

October 10, 2025

October Economic Forecast: What the Market and Economy May See in 2025

The U.S. economy is sending mixed signals as we enter the last quarter of 2025. Rate cuts, GDP surprises, inflation pressures, and job market shifts all shape what’s ahead. While no forecast is perfect, looking at the data together helps us better understand where the economy and markets may be heading. Fed Cuts Interest Rates — and Signals More to...

July 10, 2025

Should You Move States in Retirement? Why 53% of Movers Come Back

What high-net-worth retirees need to know before relocating for taxes, weather, or lifestyle The Allure of Relocation: Why So Many Consider Moving After decades of building wealth, it’s natural to wonder if a new state could stretch your retirement dollars further. The appeal is obvious: But before you start packing, it’s crucial to look beyond the headlines. While relocating can...

July 10, 2025

How to Recover After a 30% Portfolio Loss in Retirement

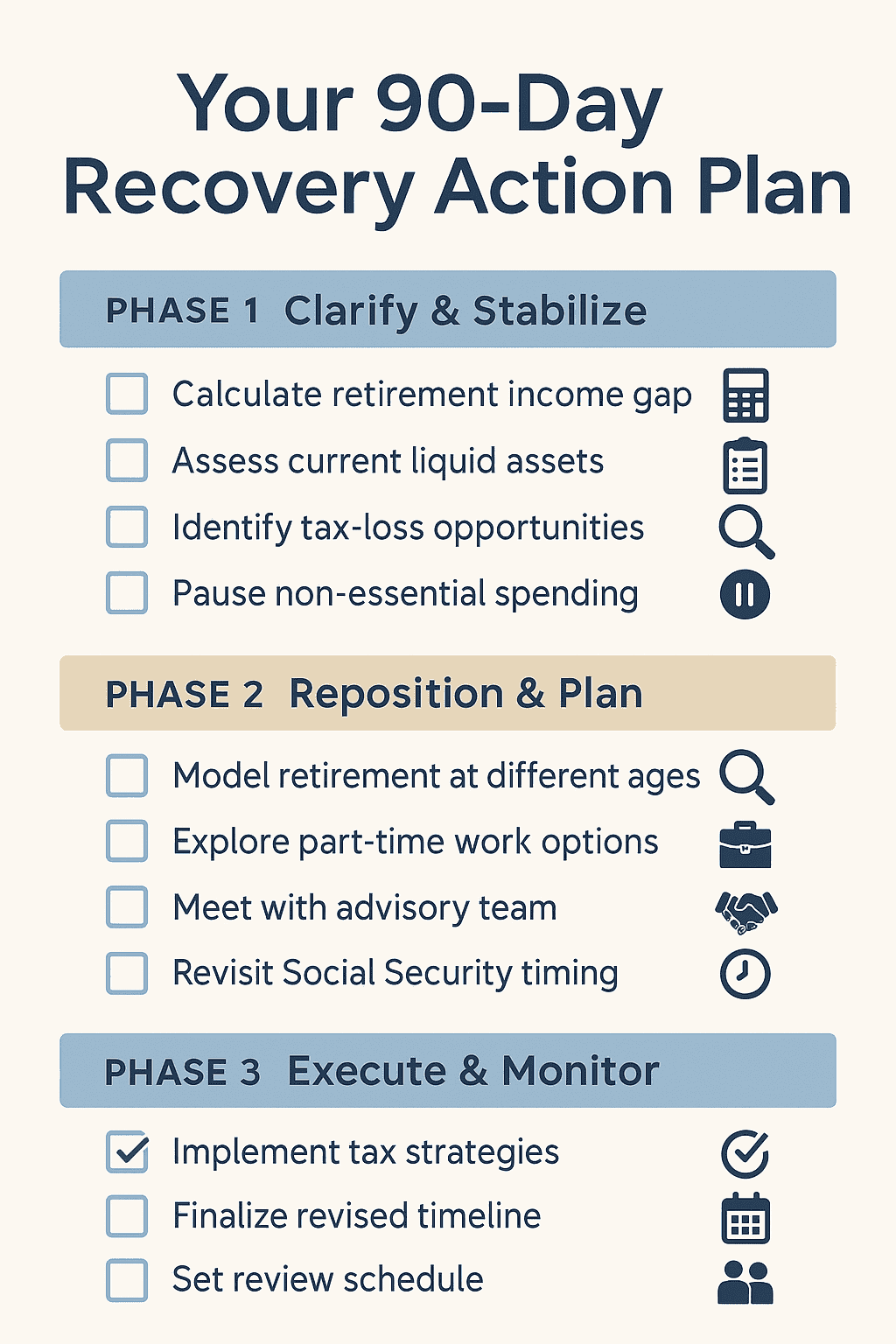

If you’re nearing retirement and just saw your portfolio drop by 30%, it’s hard not to feel a wave of anxiety. You’ve spent decades building wealth—strategically investing, consistently saving, and working toward a retirement you could enjoy without worry. Now, the numbers look different. The plan feels uncertain. And the timing couldn’t feel worse. But here’s the truth: What you...

May 22, 2025

How To Choose the Right Investments for Retirement

TLDR Making important decisions about investment strategies in advance of retirement will guarantee growth and stability of funds throughout your post-retirement years. With correct planning, your nest egg can be maintained, and even grown, to ensure a comfortable retirement income and offer you the ability to take care of loved ones after you’ve left the workplace. With so many investment...

May 22, 2025

Test Your Financial Literacy: Take the Ultimate Financial Knowledge Quiz

TLDR Are you ready to test your financial knowledge? Whether you are a seasoned investor or just starting your financial journey, understanding the fundamentals of financial planning is crucial. This financial acumen quiz is designed to test your knowledge of key financial concepts, from the importance of a diversified investment portfolio to the principles of financial planning and investment strategies....

April 15, 2025

April 2025 Economic Forecast: Navigating Turbulence Amid Policy Shifts

The global and U.S. economies are facing significant challenges in April 2025, driven by aggressive tariff policies, inflationary pressures, and labor market dynamics. While the labor market remains resilient, mounting uncertainties are reshaping economic growth trajectories and consumer behavior. Here’s an analysis of the current economic landscape, its causes, and implications for the months ahead. Economic Growth: Slowing Momentum Global...

April 15, 2025

Navigating 2025’s Markets: Balancing Stocks and Bonds for Stability

As we move deeper into 2025, investors face a rapidly evolving financial landscape marked by volatility, inflation concerns, and shifting economic policies. Striking the right balance between stocks and bonds is more critical than ever for building a resilient portfolio. Stocks vs. Bonds in 2025: Which Is Right for Your Portfolio? The debate between stocks and bonds remains central to...

October 7, 2024

10 Tips to Protect Your Retirement Savings from Inflation

Inflation is often called the “silent thief” of retirement savings. It can erode the purchasing power of your money over time, potentially derailing even the most carefully laid retirement plans. But do not worry – there are strategies you can employ to help safeguard your nest egg from the effects of inflation. How Does Inflation Impact My Retirement? Before diving...

September 30, 2024

Fiduciary Financial Advisors: Help Secure Your Financial Future with Trustworthy Expertise

When it comes to managing your finances and planning for the future, finding the right guidance is crucial. You may have heard the term “fiduciary financial advisor” and wondered what it means, why it matters, and how to find a fiduciary financial advisor near you. Not all financial advisors are the same. Some provide higher levels of service, expertise, and...

September 17, 2024

401(k) to IRA Rollover Guide: Maximize Your Retirement Savings

401K Rollover to IRA Rules There are two types of rollovers: direct rollovers and indirect rollovers. In a direct rollover, the funds from your 401(k) are transmitted directly to the new retirement plan. There are no withdrawal fees or distributions to the participant, making this the most hands-off rollover method. An indirect rollover is where the funds from your 401(k)...

September 10, 2024

401(k) Rollover Guide: Best Options for Your Old Retirement

What Are My 401(K) Rollover Options? When an employee leaves their job, they have to decide what to do with their old 401(k) retirement account. There are five common options you can consider that include: When Would I Want to Leave My Old 401(k) with My Former Employer? Leaving your old 401(K) account with your former employer is the easiest...

August 20, 2024

What Happens to a 401(K) When You Quit?

When an employee separates service from an employer with a 401(k), they must determine what to do with the retirement account. With the stress of change, sometimes determining what to do with your group retirement plan falls to the wayside. Adding on top having to figure out the options, it can be easier to try and ignore your account, than...

May 7, 2024

How Much Money Do I Need to Retire?

Understanding how much money you need to retire is one of the biggest questions we get from our clients, and it is one question we find they do not think about soon enough, or often enough. It is a question that lacks a one-size-fits-all answer, as the ideal retirement savings can vary greatly depending on individual circumstances, lifestyle choices, and...

April 26, 2024

Is $1 Million Enough to Retire?

TLDR Planning for retirement is a significant financial milestone for many individuals. Among the many questions that arise during this planning phase, perhaps one of the most common is, “How far can $1 million take me in retirement?” While $1 million might sound like a substantial sum, its purchasing power in retirement can vary widely depending on factors such as:...

April 2, 2021

What is the Difference between Traditional and Roth Tax Deferring Accounts?

Retirement vehicles come primarily in two forms Traditional and Roth. These are most commonly found in IRAs (Individual Retirement Accounts) or 401(K)s. They are both tax-advantaged vehicles designed for long-term savings and investments, to help people plan for their long-term goals, such as retirement. Each type of account has its own advantages and disadvantages. The right account for you will...