March 2, 2026

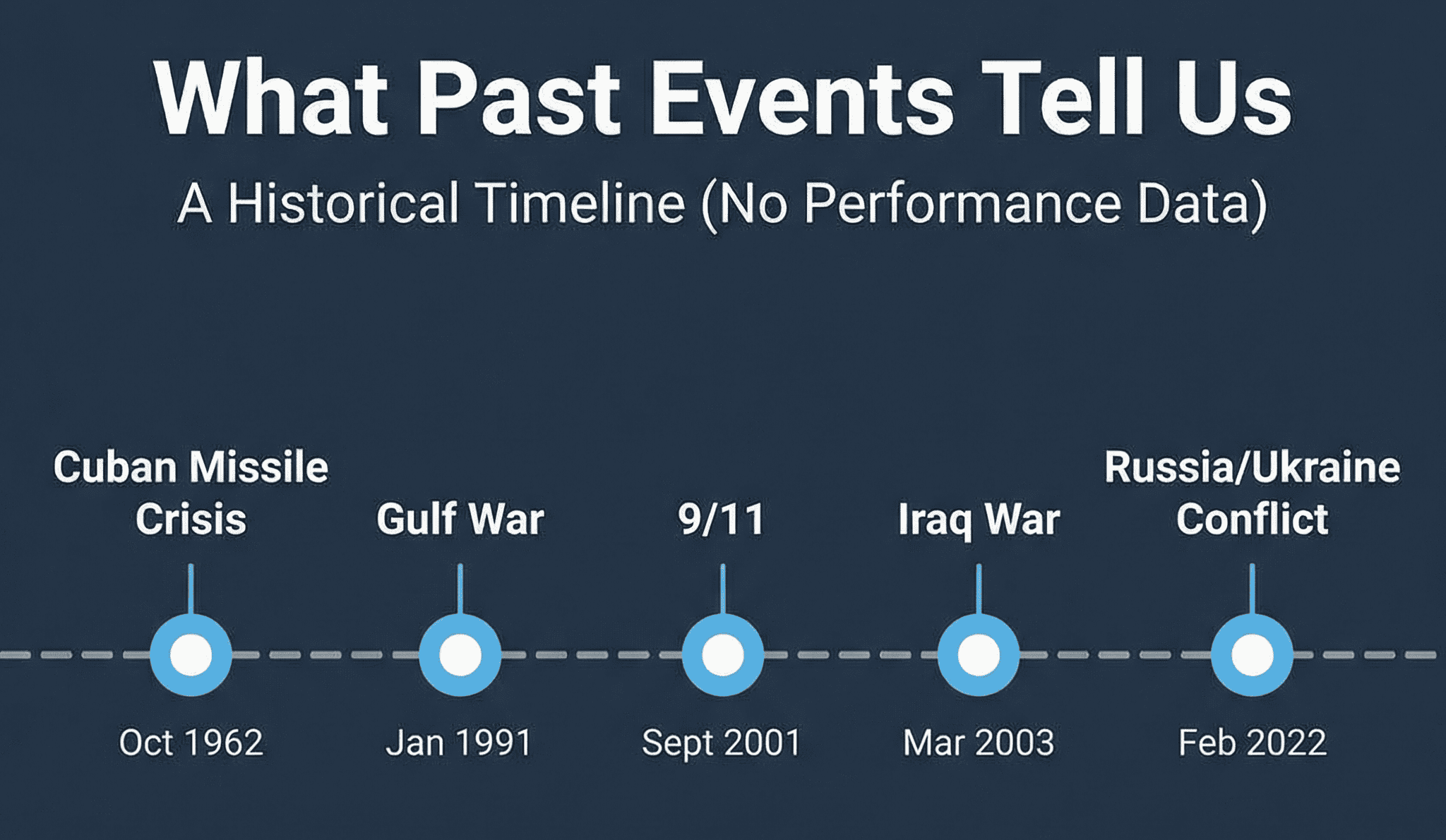

What History Suggests About Market Shocks

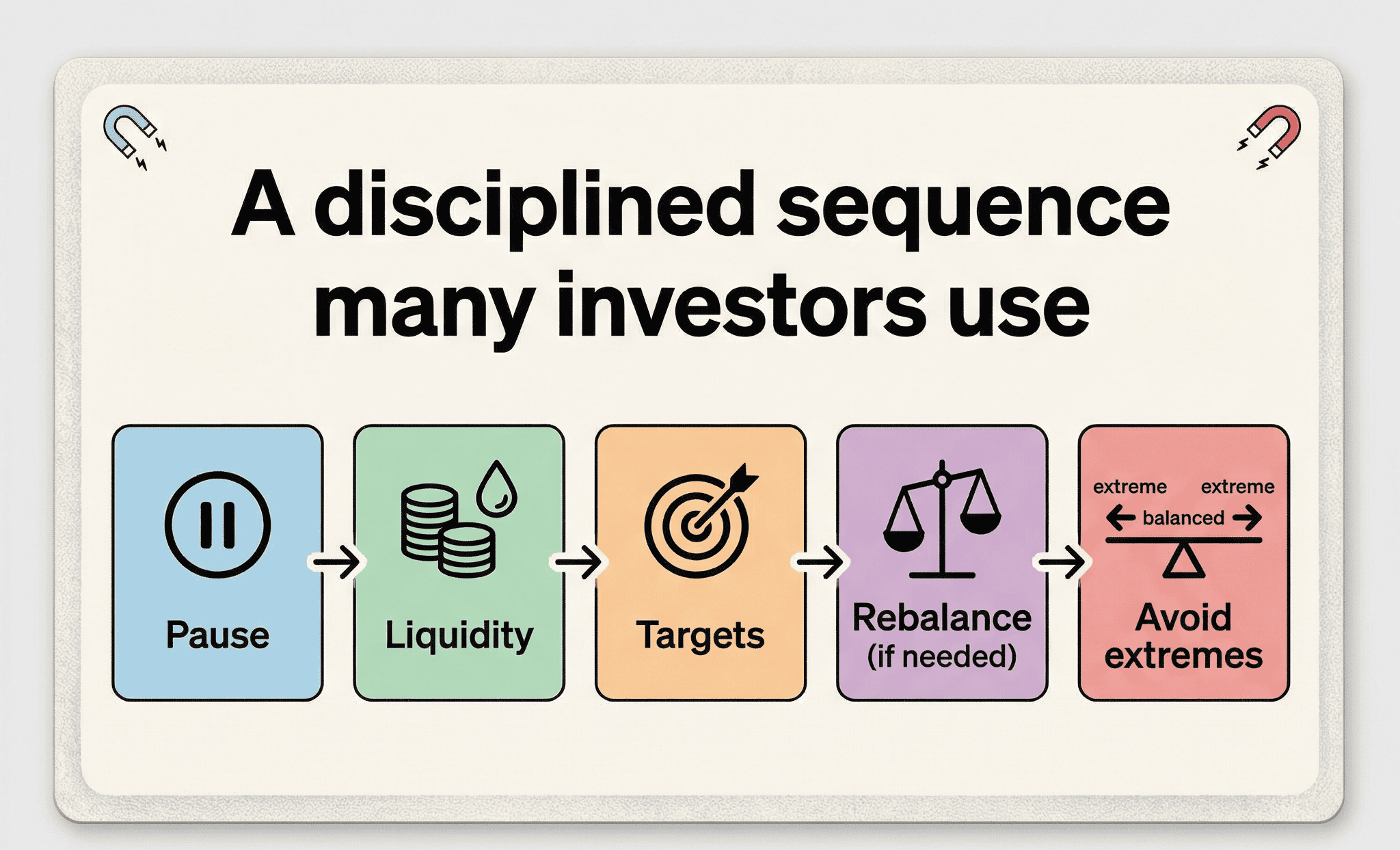

When headlines get loud, the instinct to act is understandable. Military escalation. Regional conflict. Market swings that feel different this time. If you’re nearing retirement or already there, questions start forming quickly. Is this the beginning of something bigger? Should I move to cash? Will my retirement income hold? These are reasonable questions. And history offers some useful perspective. Markets...

February 23, 2026

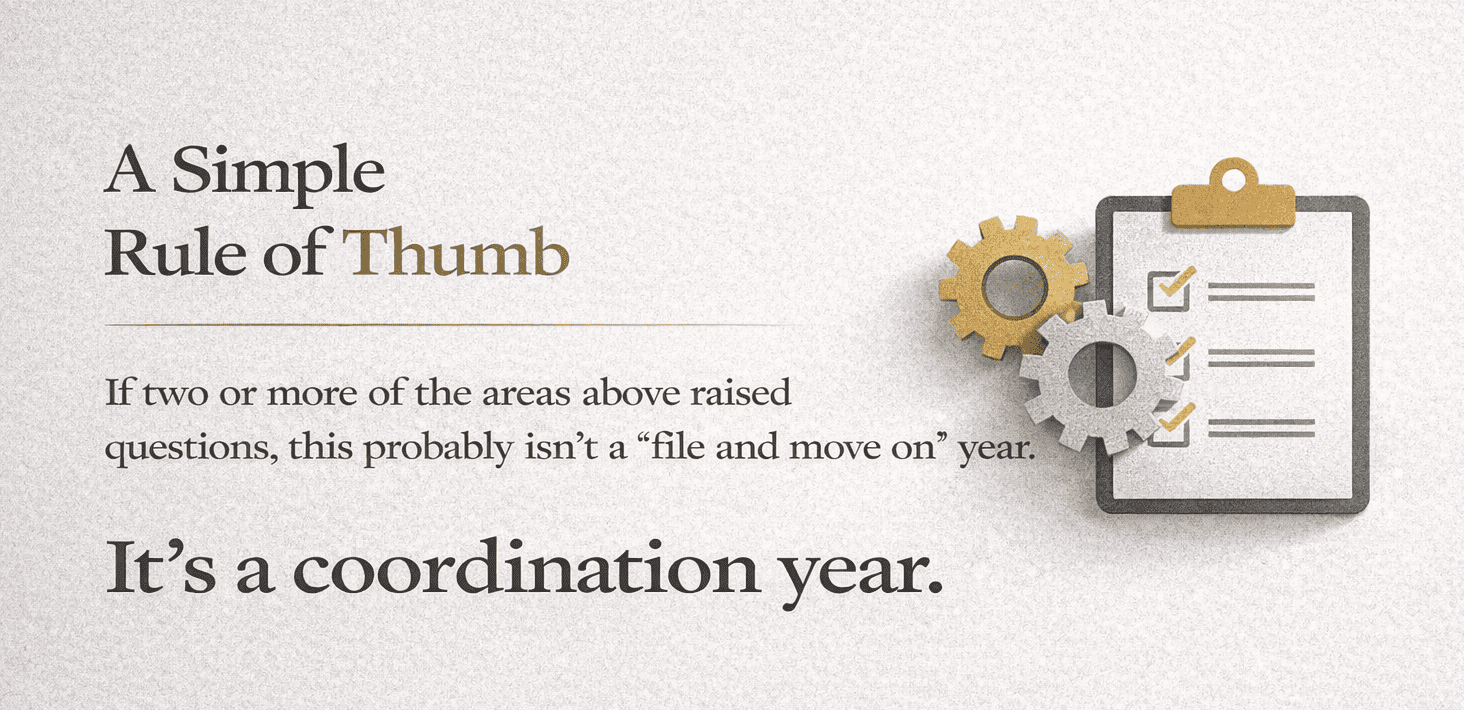

A Simple Way to Tell If You Should Act Before April 15

Not everyone needs to make a move before April 15. But some people absolutely should and most of them don’t realize it until the window has already closed. The challenge usually isn’t complexity. It’s knowing whether this is simply a filing year, or a coordination year. There’s a meaningful difference between the two. Filing years are maintenance. Coordination years are...

February 23, 2026

What You Can Still Control Before April 15

Most people treat April 15 as a finish line. You gather your documents, file your return, write a check or pocket a refund and move on until next year. But for retirees and those approaching retirement, tax season is more than an annual obligation. It’s one of the few moments when your entire financial picture comes into focus at once....

February 17, 2026

When Market Leadership Changes, Retirement Plans Should Adjust

For several years, a small group of large technology companies drove much of the market’s return. That leadership created strong gains. It also created concentration. Now, signs suggest leadership may be broadening. That is not unusual — markets rotate. The important question is not whether technology continues to lead. The important question is whether your retirement plan depends on it....

February 17, 2026

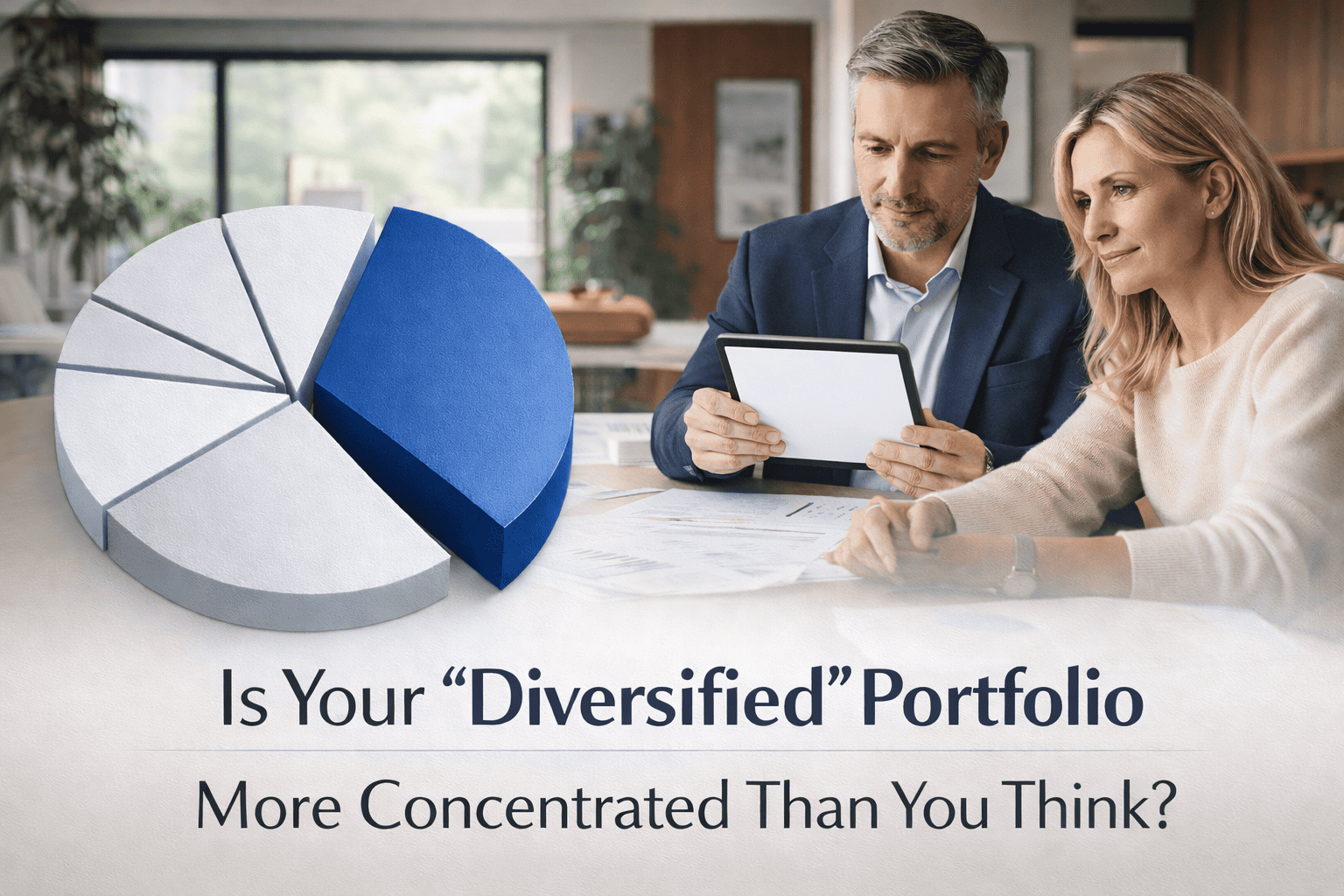

The Recent Tech Drop Is a Reminder to Review Diversification

For many investors, the surprise wasn’t that technology stocks fell over the past several weeks. It was how much their “diversified” portfolio moved with them. Artificial intelligence did not disappear. Innovation did not stop. What changed were expectations. Investors began reassessing how quickly heavy AI spending would translate into earnings, and as those expectations adjusted, stock prices followed. Because a...

February 10, 2026

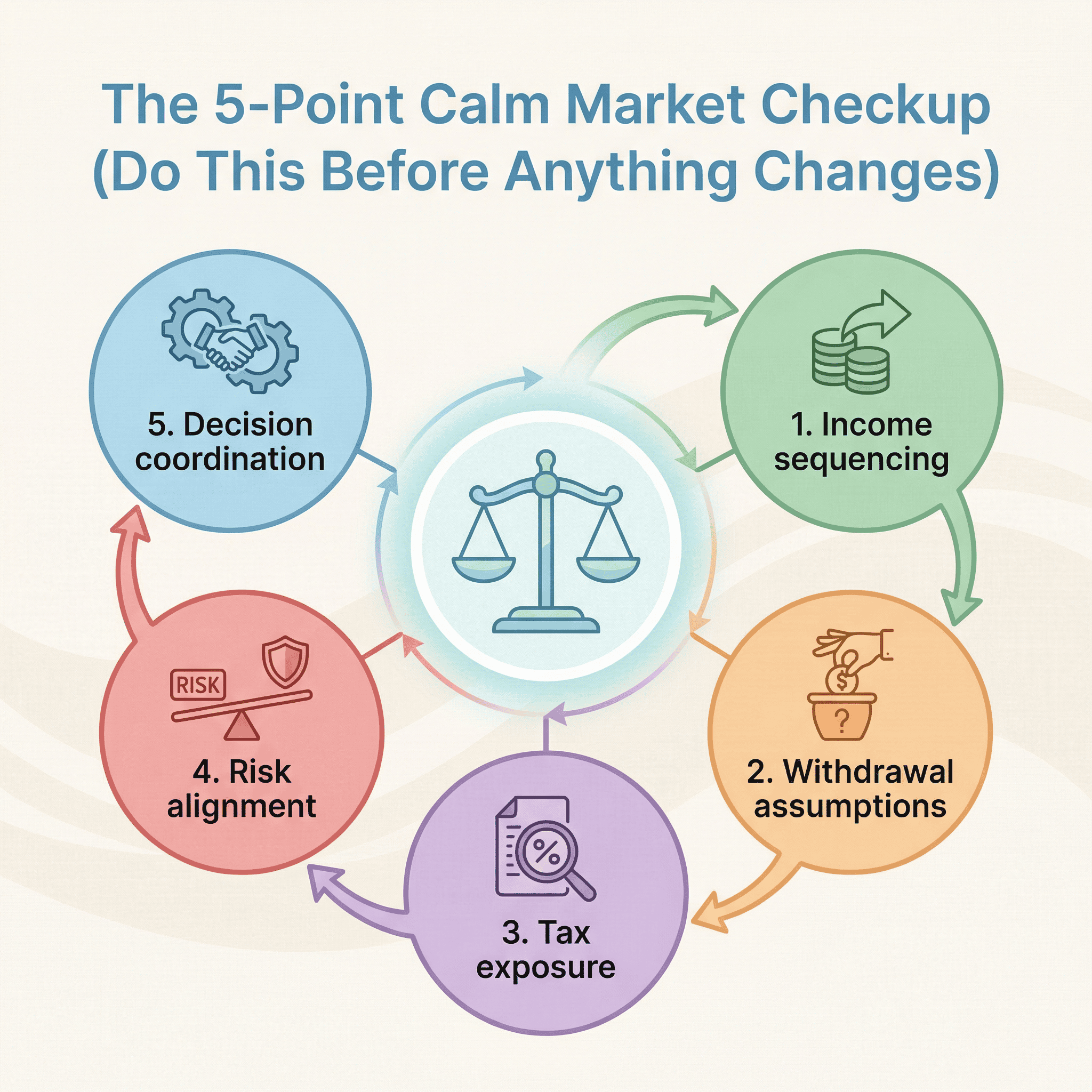

Why Calm Markets Are the Best Time to Strengthen a Retirement Plan

Nobody calls their advisor when things are going well. Markets are steady. Statements look fine. Nothing hurts. So they do nothing. And that’s exactly when the most valuable planning work can happen — but almost nobody does it. Here’s the problem: by the time something forces you to look at your plan, your options have already shrunk. You’re reacting. You’re...

February 10, 2026

A Simple Way to Tell If Your Plan Is Too Dependent on Market Timing

They did everything right. Saved consistently for thirty years. Stayed diversified. Didn’t panic during 2008 or 2020. Retired at 63 with a solid portfolio and a plan that looked great on paper. Then markets dropped 18% in their first year of retirement. Not a catastrophe—but enough that their $7,500 monthly withdrawals started eating into a shrinking base. By the time...

January 27, 2026

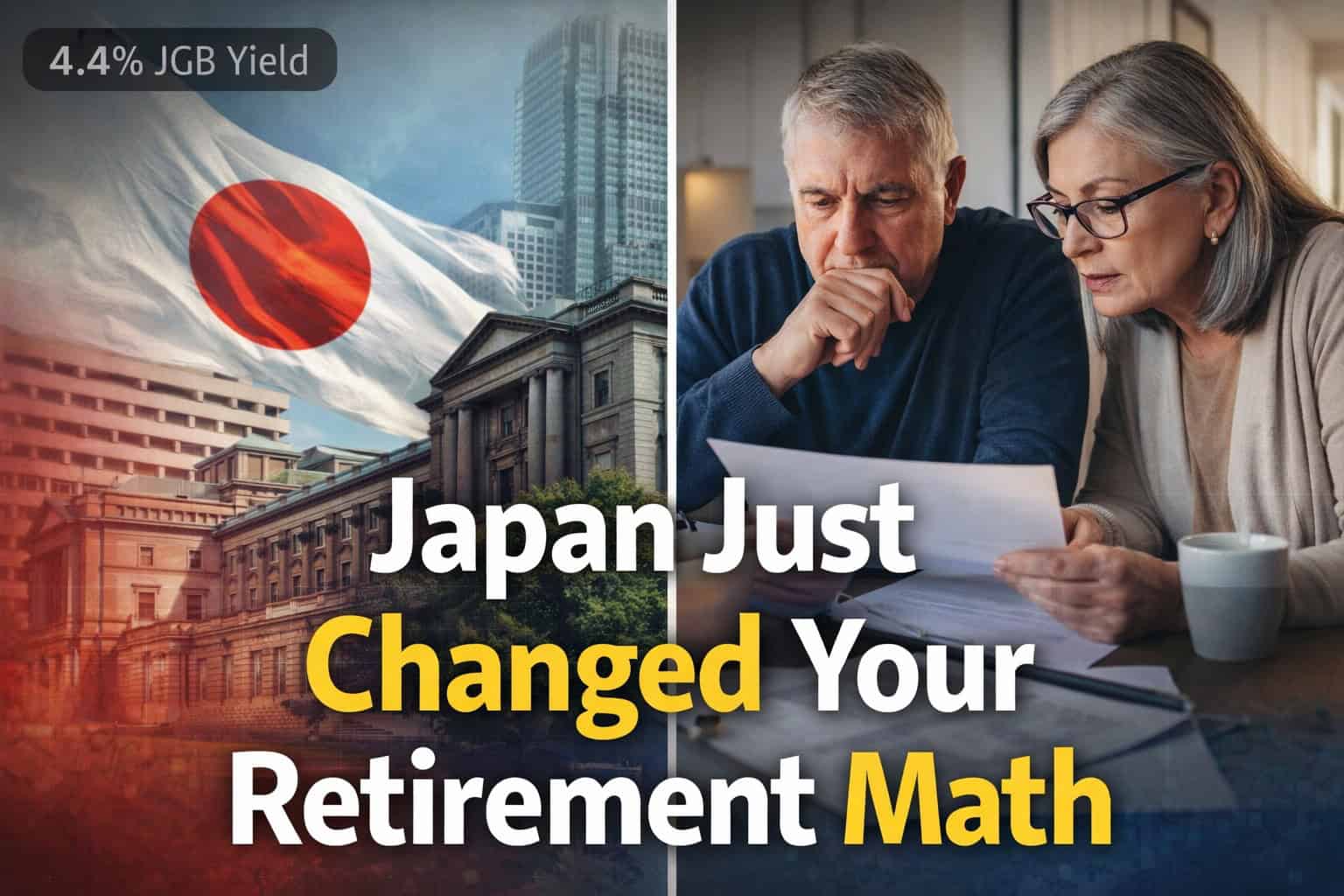

Why a Quiet Crisis in Japan’s Bond Market Could Shake Your Retirement Plans—And What You Can Do Now

How global bond shifts may be silently impacting your retirement security (and how to protect yourself) Tom and Susan Thought They Were Ready to Retire They’d saved for thirty years, built what looked like a solid nest egg, and even booked a celebratory cruise to Alaska. But during what should have been a routine check-in with their advisor, one quiet...

January 20, 2026

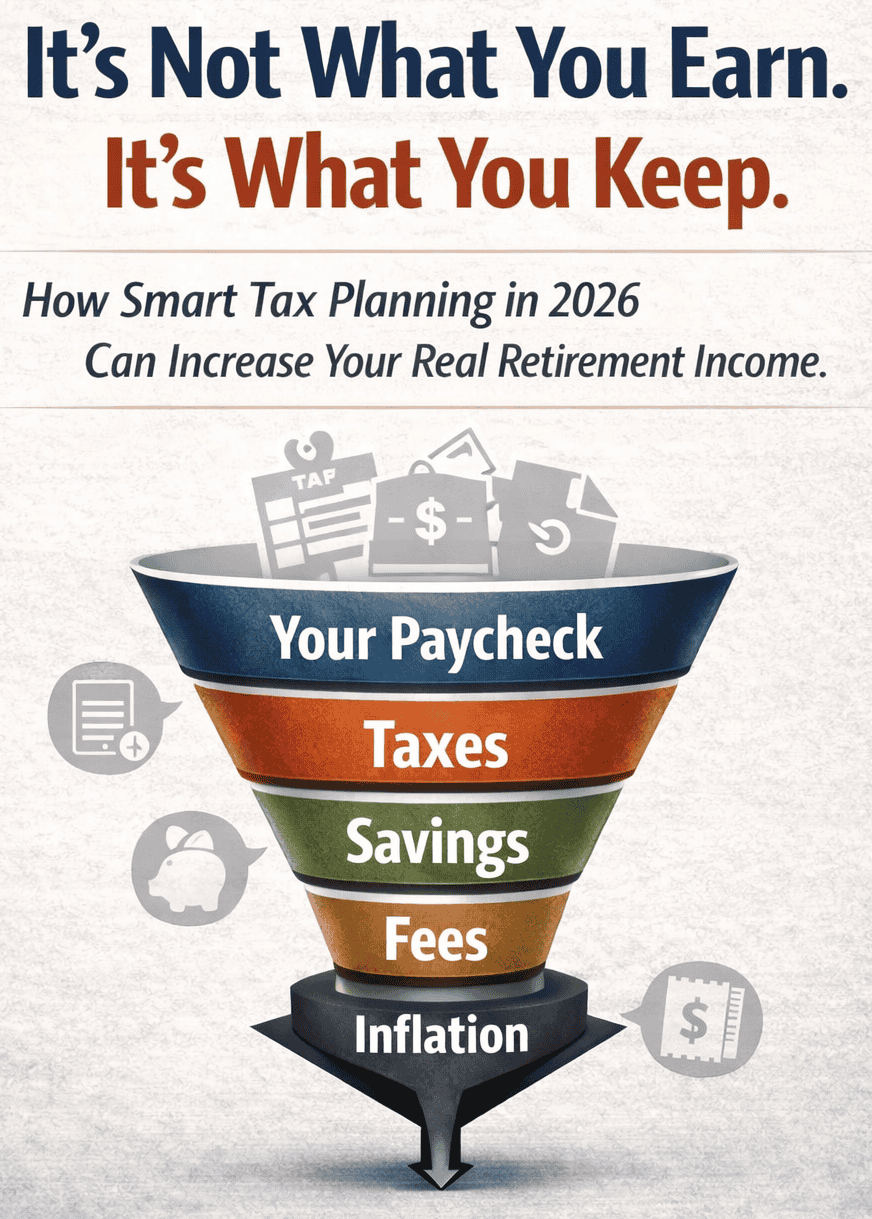

Your 2026 Tax Strategy: How to Pay Less Now and Create More Income in Retirement

When most people think about taxes, they think about April. Smart planning looks much further ahead. Because the truth is, you don’t retire on balances. You retire on after-tax income — what actually shows up in your bank account each month after the IRS takes its share. And the way you save, invest, and structure your taxes in 2026 can...

January 14, 2026

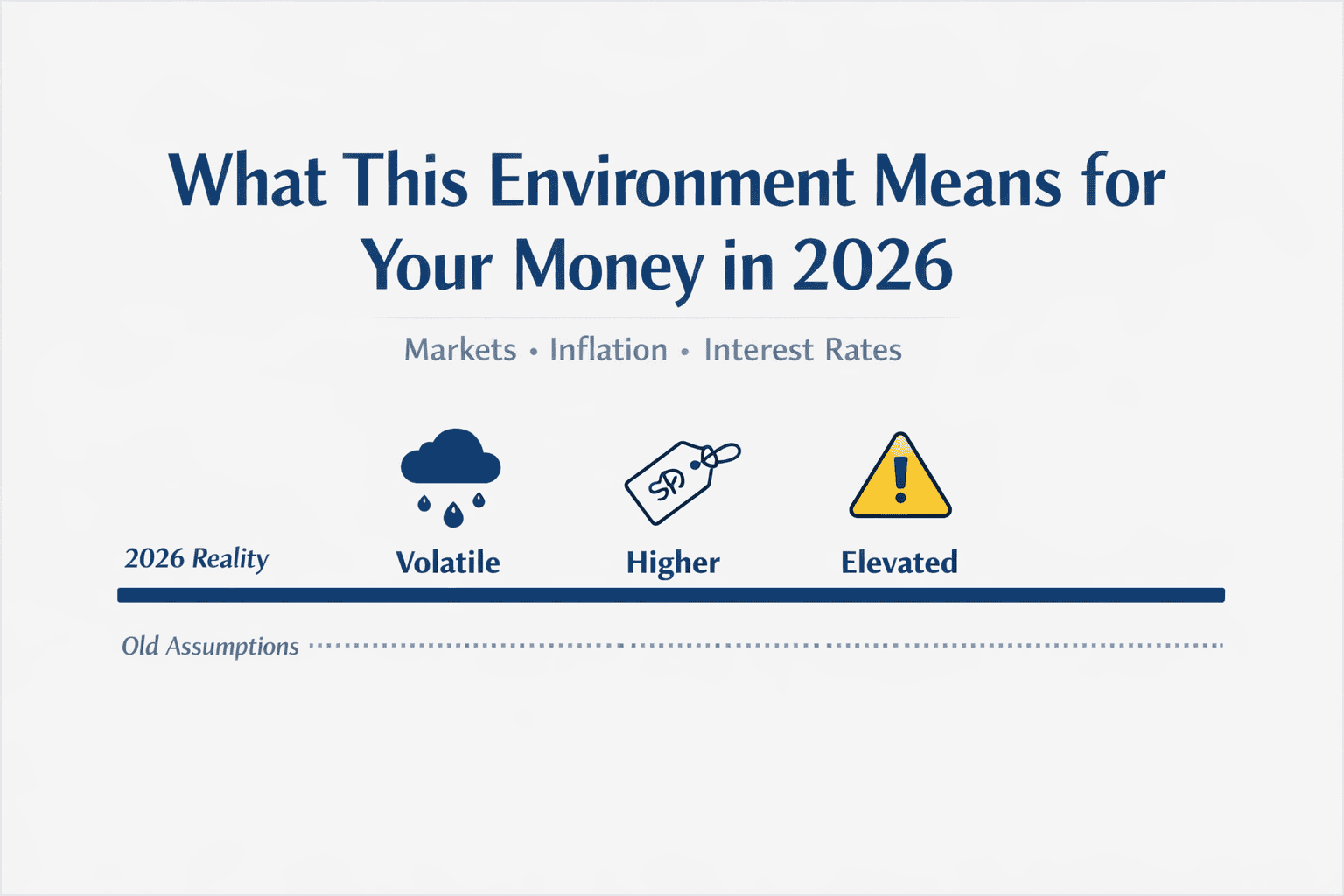

2025 Didn’t End the Way Most People Think It Did — Here’s What Really Happened

What the Markets, Inflation, and Interest Rates Actually Mean for Your Money in 2026 Here’s something worth paying attention to:The story most people are hearing about 2025 is missing some important context—and understanding what actually happened (versus what the headlines suggest) matters more than you might think. I’m not here to predict what happens next or tell you what to...

January 13, 2026

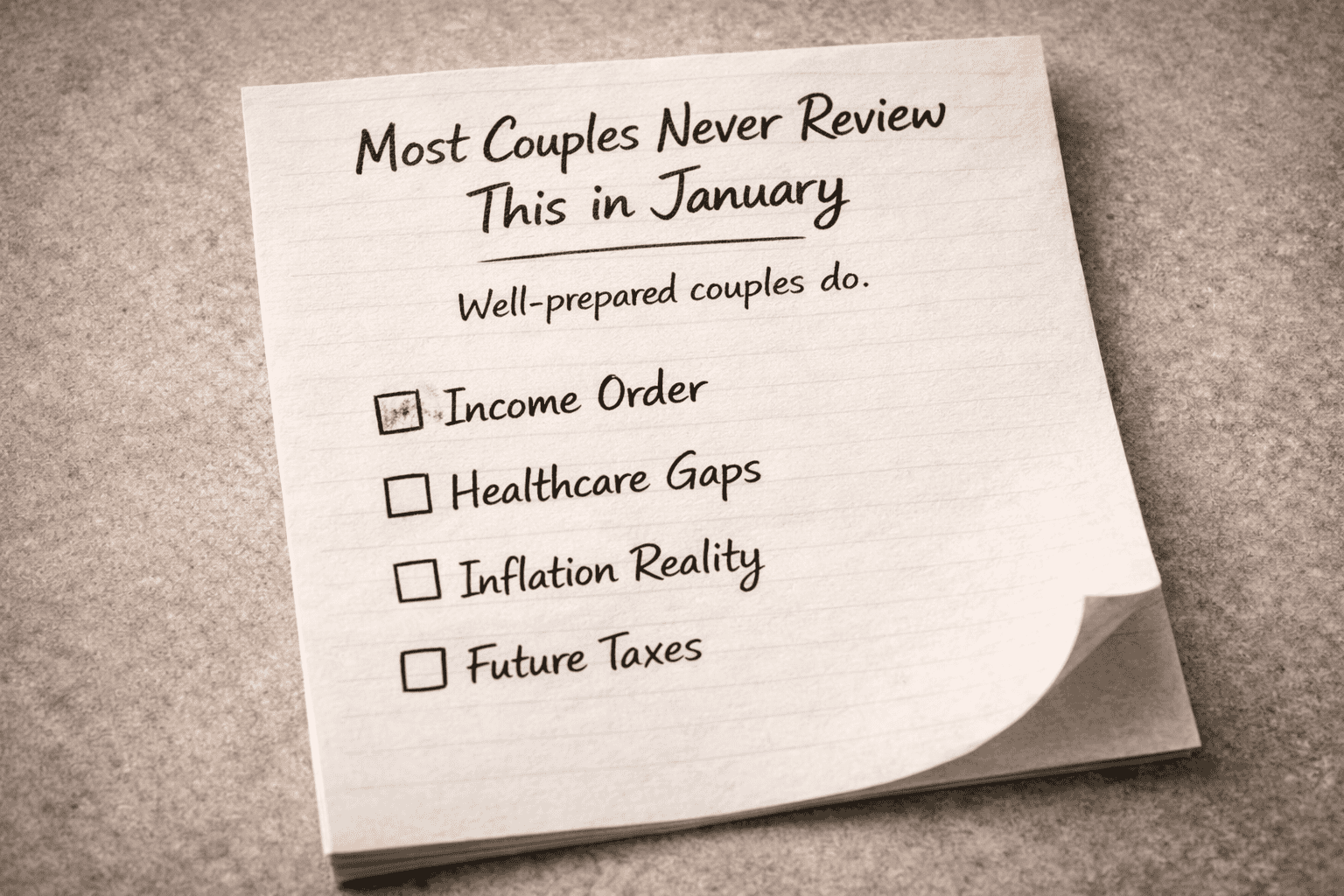

What Well-Prepared Couples Review Every January — Before Retirement

62% of pre-retirees are uncertain their savings will last through retirement. But here’s the thing: it’s rarely about how much you saved. It’s about whether you’ve reviewed the five areas that actually determine if your retirement works. Retirement issues rarely show up early. They show up later—when choices are limited, income matters more, and mistakes feel permanent. January is the...

October 12, 2025

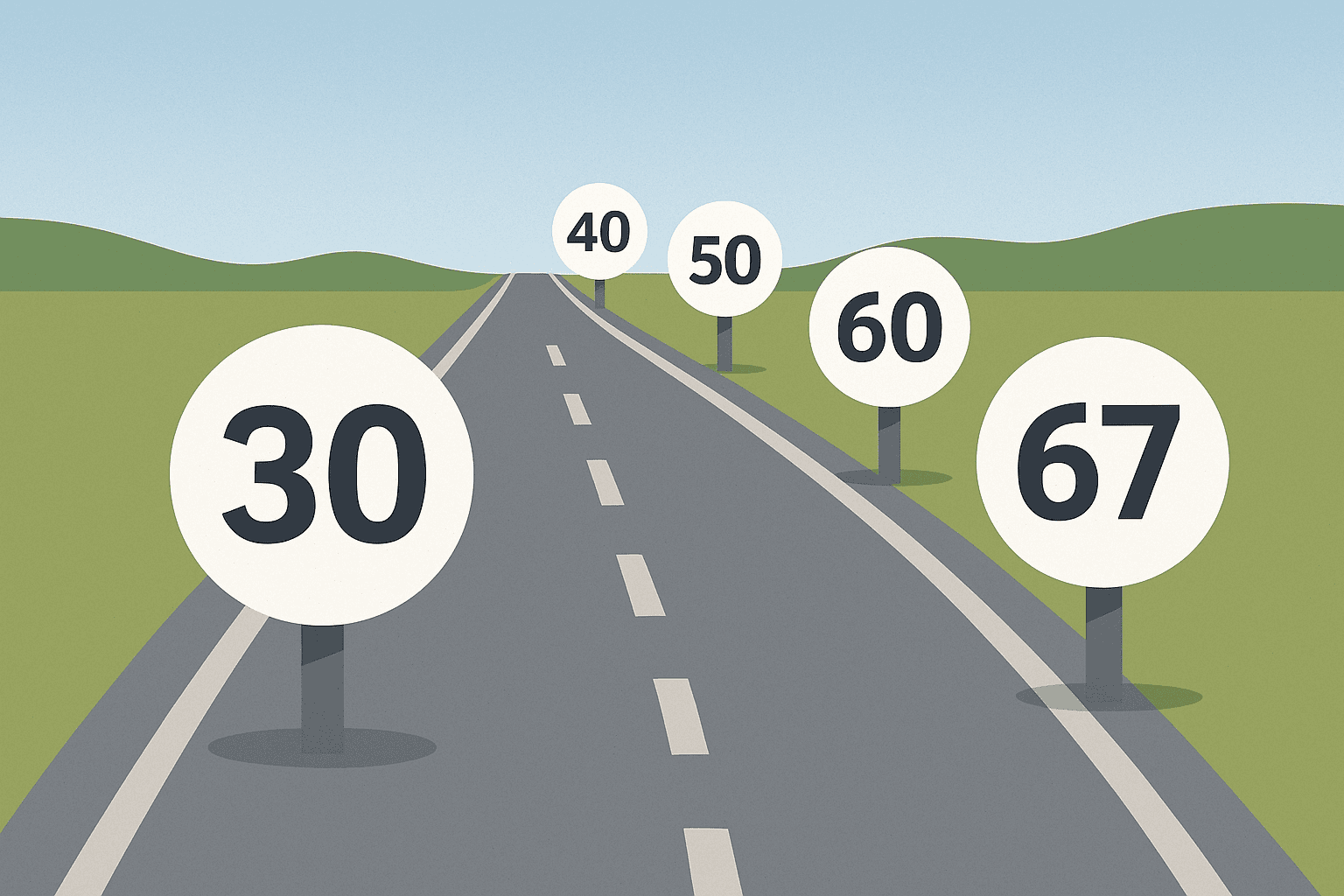

How Much Should I Have Saved in My 401(k) at Key Ages?

Many people wonder, “Am I on track with my 401(k)?” Having a few checkpoints can help you see where you stand — and what small changes can make a big difference. 401(k) Benchmarks: What Experts Suggest Financial planners often use income multiples as targets: Age Suggested Savings Target Why It Helps 30 1× your annual pay Get your footing early...

October 10, 2025

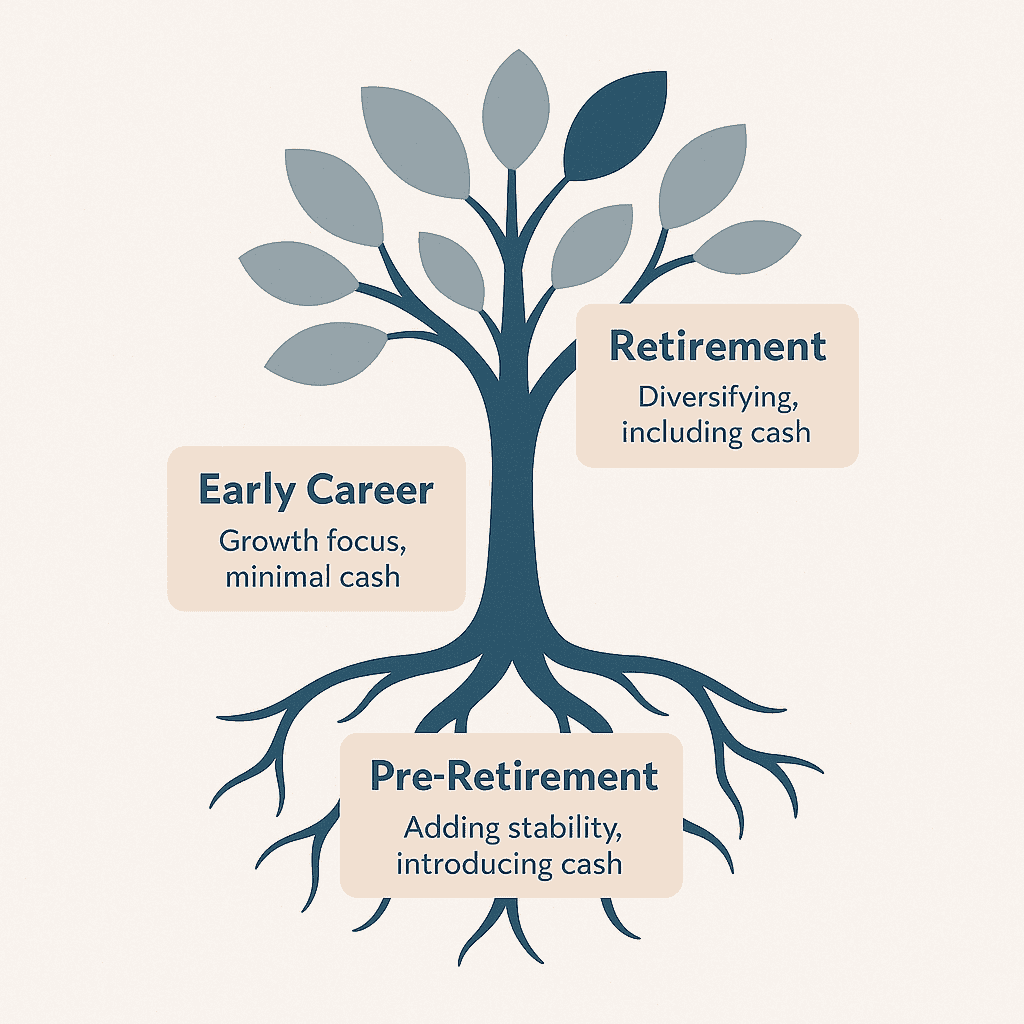

The Role of Cash in a Retirement Portfolio

Cash feels safe. You can see it. You don’t have to worry about stock prices. But too much cash—or too little—can hurt your long-term retirement goals. Let’s walk through how cash fits into your plan, how it changes with life stage, and how to figure out the right balance. Why Many Retirees Hold Too Much (or Too Little) Surveys show...

July 10, 2025

Should You Move States in Retirement? Why 53% of Movers Come Back

What high-net-worth retirees need to know before relocating for taxes, weather, or lifestyle The Allure of Relocation: Why So Many Consider Moving After decades of building wealth, it’s natural to wonder if a new state could stretch your retirement dollars further. The appeal is obvious: But before you start packing, it’s crucial to look beyond the headlines. While relocating can...

July 10, 2025

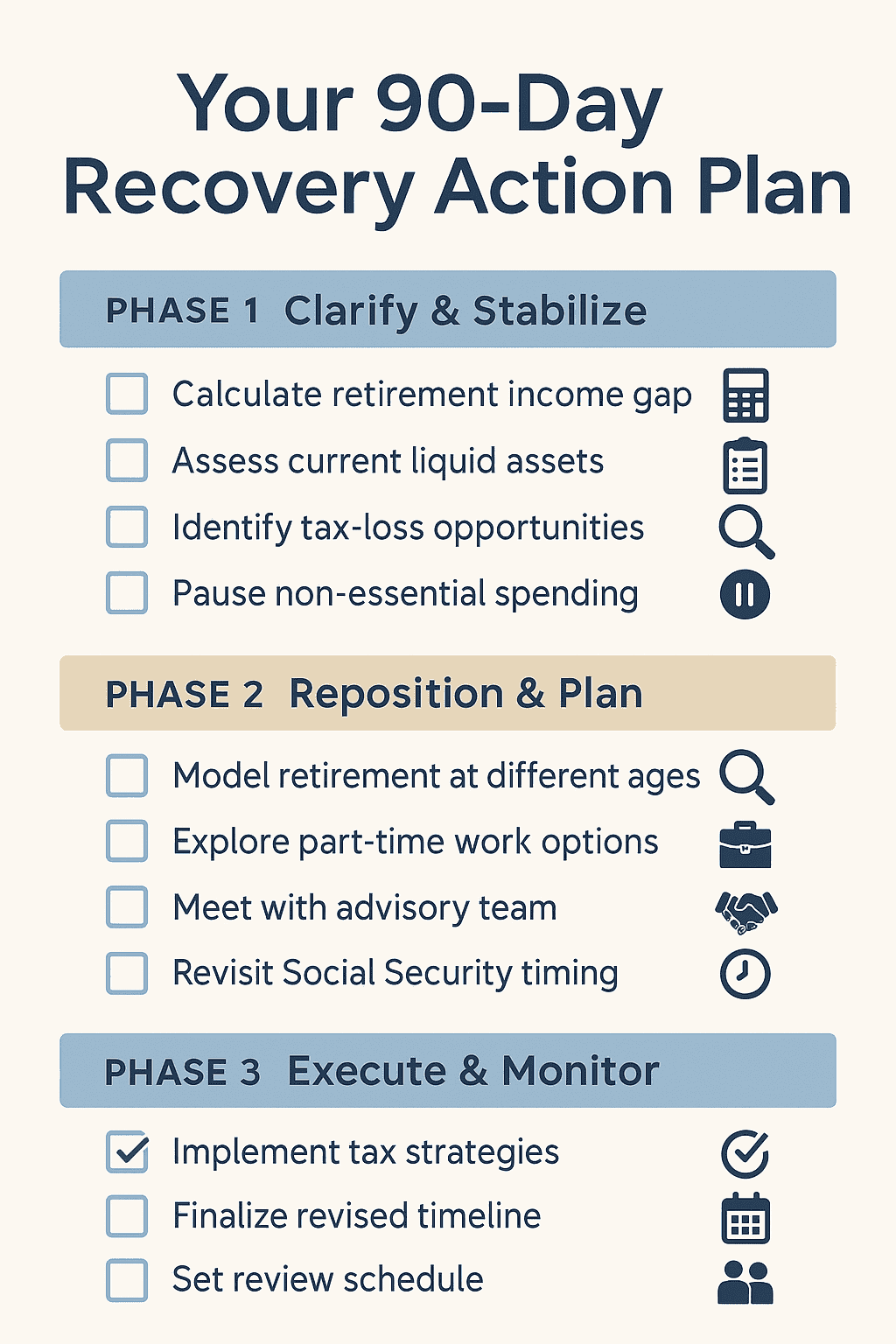

How to Recover After a 30% Portfolio Loss in Retirement

If you’re nearing retirement and just saw your portfolio drop by 30%, it’s hard not to feel a wave of anxiety. You’ve spent decades building wealth—strategically investing, consistently saving, and working toward a retirement you could enjoy without worry. Now, the numbers look different. The plan feels uncertain. And the timing couldn’t feel worse. But here’s the truth: What you...

June 9, 2025

Do You Know Your Financial Finish Line? The Most Important Number You’re Not Tracking

Most people can tell you their salary, their mortgage balance, and how much they have in their 401(k). But ask them how much money they need to retire comfortably, and you’ll often get a blank stare or a vague answer about “a million dollars.” Without knowing your financial finish line, you’re essentially running a race without knowing where the finish...

June 9, 2025

Is Your Financial Team Talking to Each Other? The Hidden Cost of Siloed Professional Advice

You’ve worked hard to build a strong financial foundation. You have a trusted CPA who handles your taxes, a capable attorney who drafted your estate plan, an insurance agent who reviews your coverage annually, and a financial advisor managing your investments. On paper, you have all the professional expertise you need for comprehensive financial planning. But here’s the problem: if...

May 22, 2025

How To Choose the Right Investments for Retirement

TLDR Making important decisions about investment strategies in advance of retirement will guarantee growth and stability of funds throughout your post-retirement years. With correct planning, your nest egg can be maintained, and even grown, to ensure a comfortable retirement income and offer you the ability to take care of loved ones after you’ve left the workplace. With so many investment...

May 22, 2025

Test Your Financial Literacy: Take the Ultimate Financial Knowledge Quiz

TLDR Are you ready to test your financial knowledge? Whether you are a seasoned investor or just starting your financial journey, understanding the fundamentals of financial planning is crucial. This financial acumen quiz is designed to test your knowledge of key financial concepts, from the importance of a diversified investment portfolio to the principles of financial planning and investment strategies....