March 2, 2026

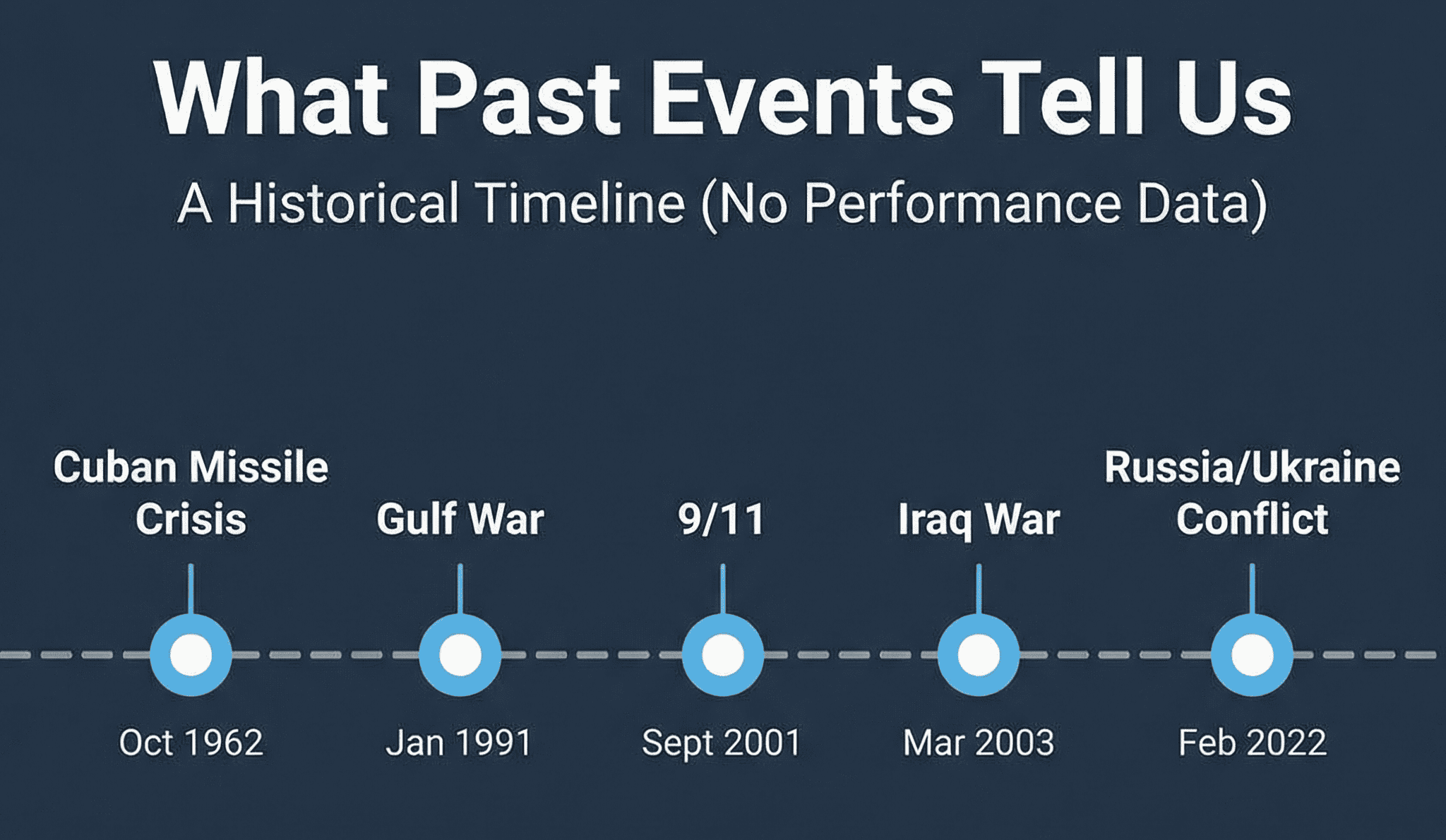

What History Suggests About Market Shocks

When headlines get loud, the instinct to act is understandable. Military escalation. Regional conflict. Market swings that feel different this time. If you’re nearing retirement or already there, questions start forming quickly. Is this the beginning of something bigger? Should I move to cash? Will my retirement income hold? These are reasonable questions. And history offers some useful perspective. Markets...

February 23, 2026

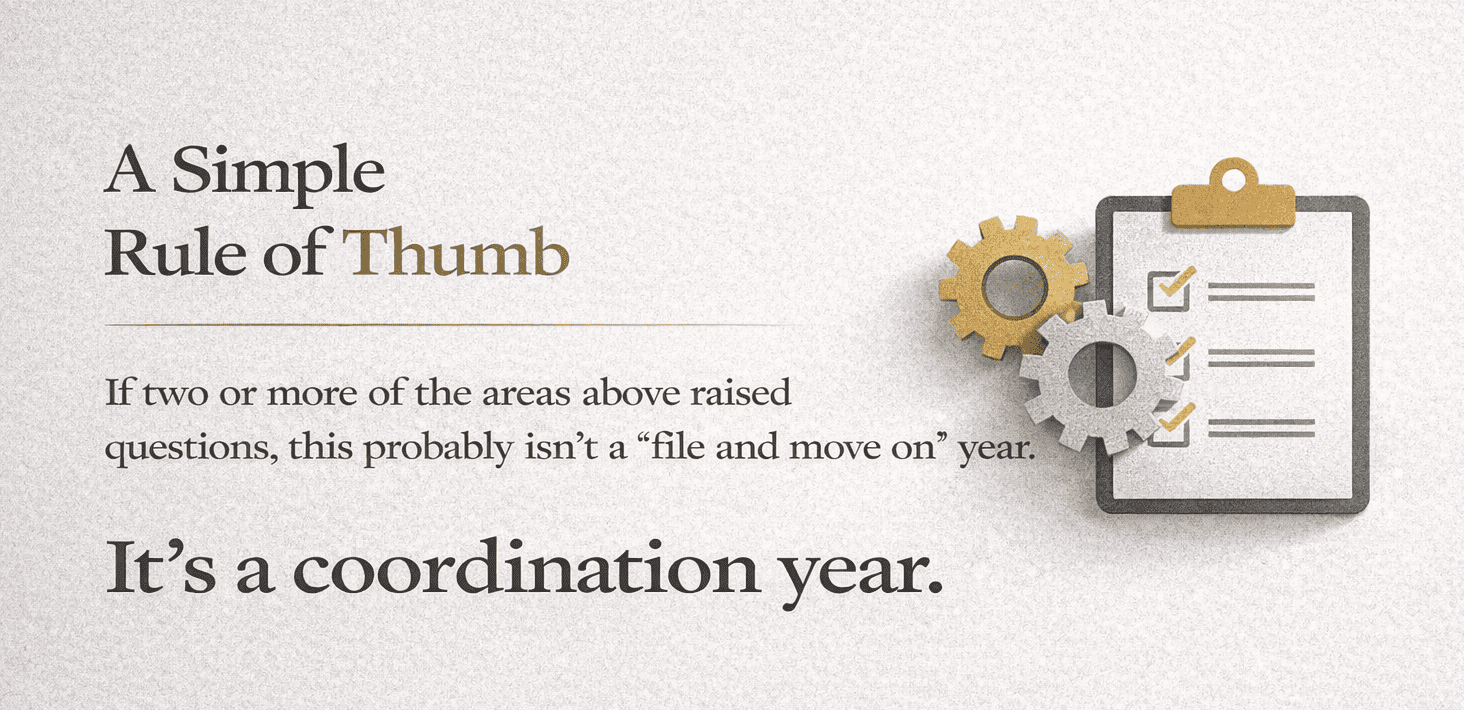

A Simple Way to Tell If You Should Act Before April 15

Not everyone needs to make a move before April 15. But some people absolutely should and most of them don’t realize it until the window has already closed. The challenge usually isn’t complexity. It’s knowing whether this is simply a filing year, or a coordination year. There’s a meaningful difference between the two. Filing years are maintenance. Coordination years are...

February 23, 2026

What You Can Still Control Before April 15

Most people treat April 15 as a finish line. You gather your documents, file your return, write a check or pocket a refund and move on until next year. But for retirees and those approaching retirement, tax season is more than an annual obligation. It’s one of the few moments when your entire financial picture comes into focus at once....

February 17, 2026

When Market Leadership Changes, Retirement Plans Should Adjust

For several years, a small group of large technology companies drove much of the market’s return. That leadership created strong gains. It also created concentration. Now, signs suggest leadership may be broadening. That is not unusual — markets rotate. The important question is not whether technology continues to lead. The important question is whether your retirement plan depends on it....

February 17, 2026

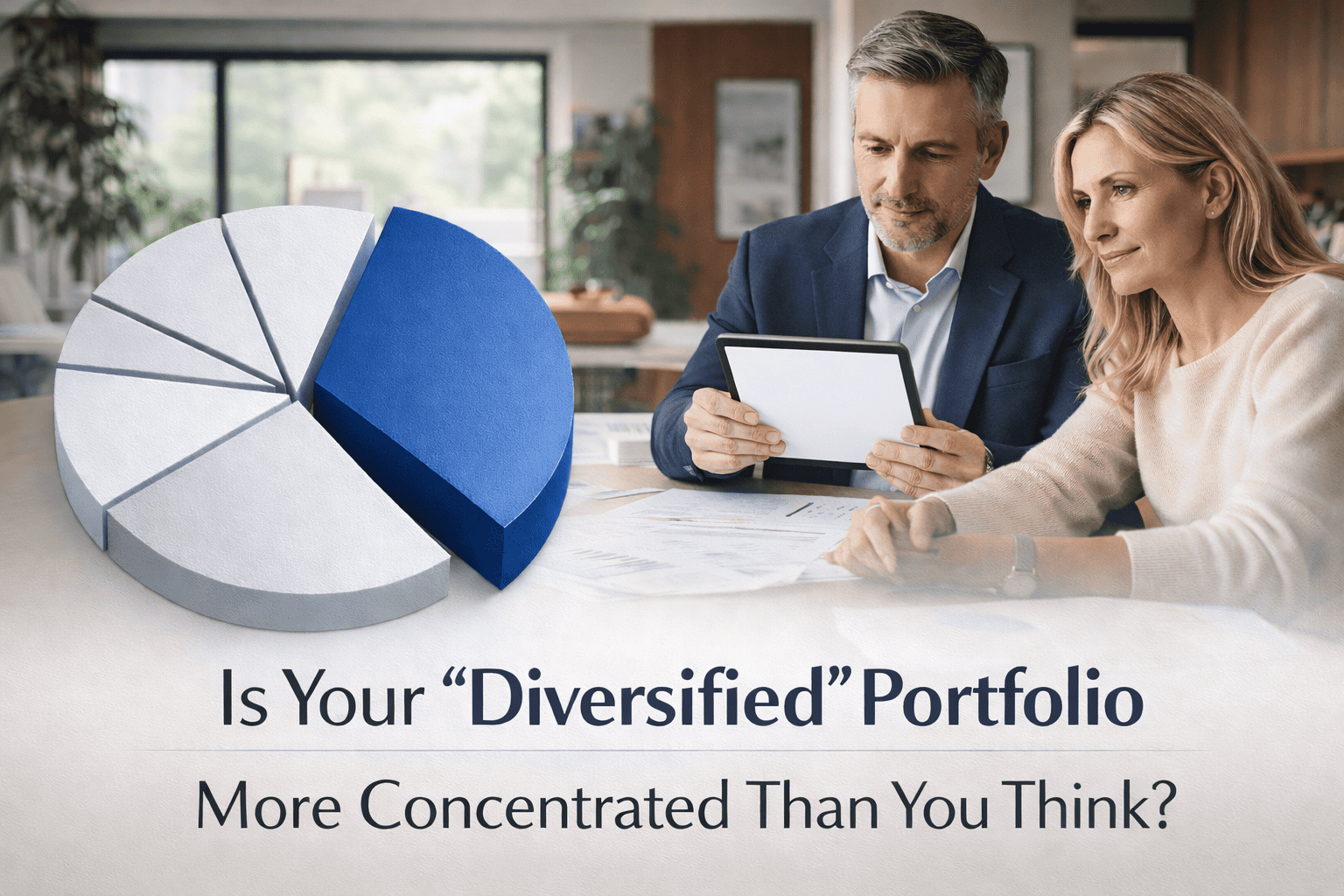

The Recent Tech Drop Is a Reminder to Review Diversification

For many investors, the surprise wasn’t that technology stocks fell over the past several weeks. It was how much their “diversified” portfolio moved with them. Artificial intelligence did not disappear. Innovation did not stop. What changed were expectations. Investors began reassessing how quickly heavy AI spending would translate into earnings, and as those expectations adjusted, stock prices followed. Because a...

February 10, 2026

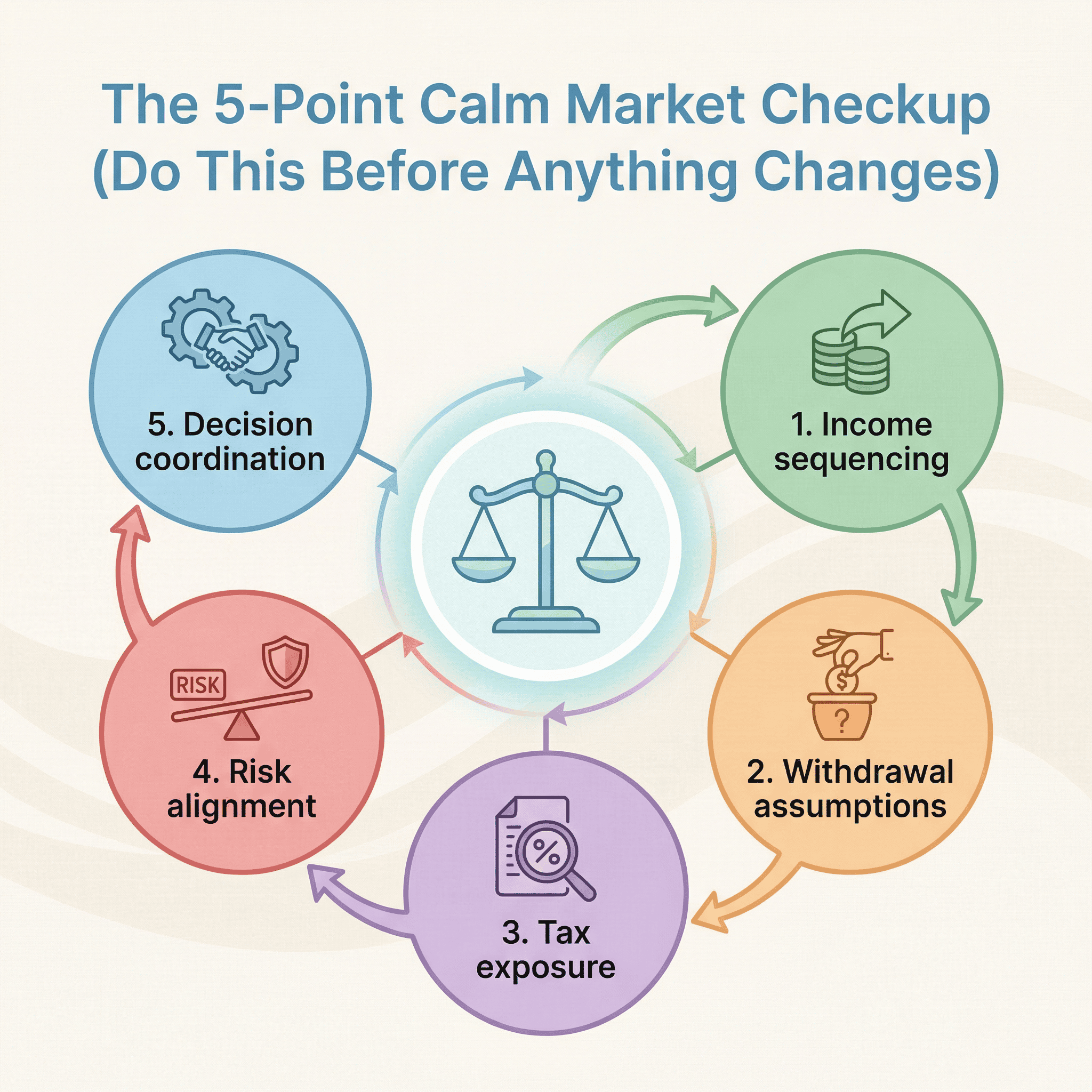

Why Calm Markets Are the Best Time to Strengthen a Retirement Plan

Nobody calls their advisor when things are going well. Markets are steady. Statements look fine. Nothing hurts. So they do nothing. And that’s exactly when the most valuable planning work can happen — but almost nobody does it. Here’s the problem: by the time something forces you to look at your plan, your options have already shrunk. You’re reacting. You’re...

February 10, 2026

A Simple Way to Tell If Your Plan Is Too Dependent on Market Timing

They did everything right. Saved consistently for thirty years. Stayed diversified. Didn’t panic during 2008 or 2020. Retired at 63 with a solid portfolio and a plan that looked great on paper. Then markets dropped 18% in their first year of retirement. Not a catastrophe—but enough that their $7,500 monthly withdrawals started eating into a shrinking base. By the time...

February 2, 2026

That Surprise ‘Big Beautiful Bill’ on Your Tax Return – What to Expect This Year and How to Turn It Into an Opportunity

You did everything right. Filed the same way you always do. Same income, same deductions, same withholding. But instead of your usual $2,000 refund, you owe $7,200. What the hell happened? If you’re one of the thousands getting hit with surprise tax bills this filing season, you’re not crazy—and you’re not alone. The shock is real. But here’s the part...

February 2, 2026

Debt Over $38 Trillion, Active Wars, New Tariffs—Could Your Portfolio Handle What’s Coming?

If you’re in your late 50s or 60s, you’ve probably noticed something: the world feels more fragile than it has in decades. The U.S. national debt just crossed $38 trillion. Wars are grinding on in Ukraine and the Middle East with no end in sight. The Trump administration is rolling out tariffs that economists warn could spike prices on everything...

January 27, 2026

Why a Quiet Crisis in Japan’s Bond Market Could Shake Your Retirement Plans—And What You Can Do Now

How global bond shifts may be silently impacting your retirement security (and how to protect yourself) Tom and Susan Thought They Were Ready to Retire They’d saved for thirty years, built what looked like a solid nest egg, and even booked a celebratory cruise to Alaska. But during what should have been a routine check-in with their advisor, one quiet...

January 27, 2026

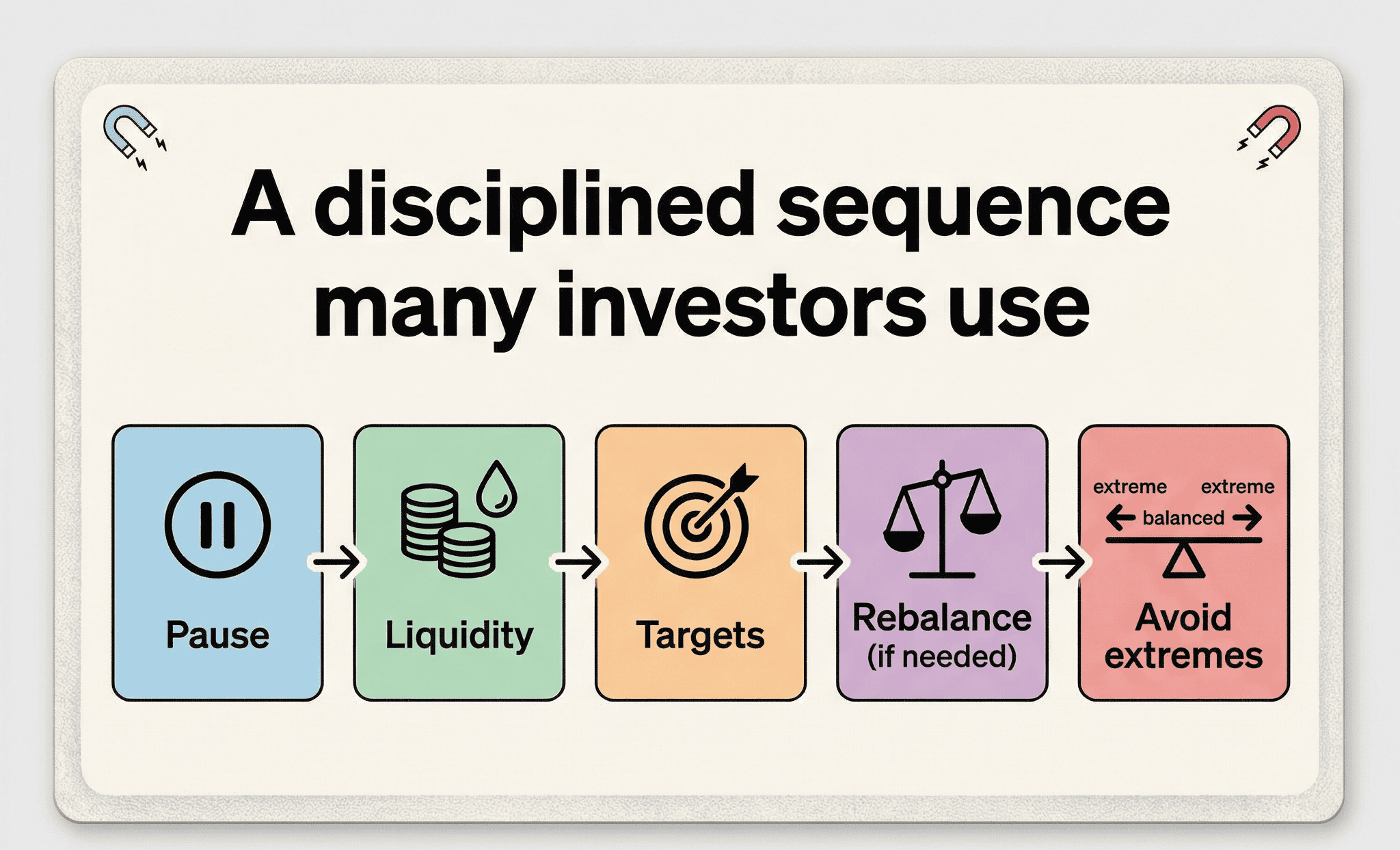

Why Ignoring Portfolio Drift Could Cost You Thousands in Retirement (And What to Do About It)

The Portfolio You Have vs. The Portfolio You Think You Have Sarah looked at her year-end statement and smiled. Her portfolio was up 18%. Nothing felt broken. Then her advisor asked a simple question: “Do you know what your current stock-to-bond ratio is?” She didn’t. Turns out, the 60/40 portfolio she’d carefully chosen three years ago was now sitting at...

January 20, 2026

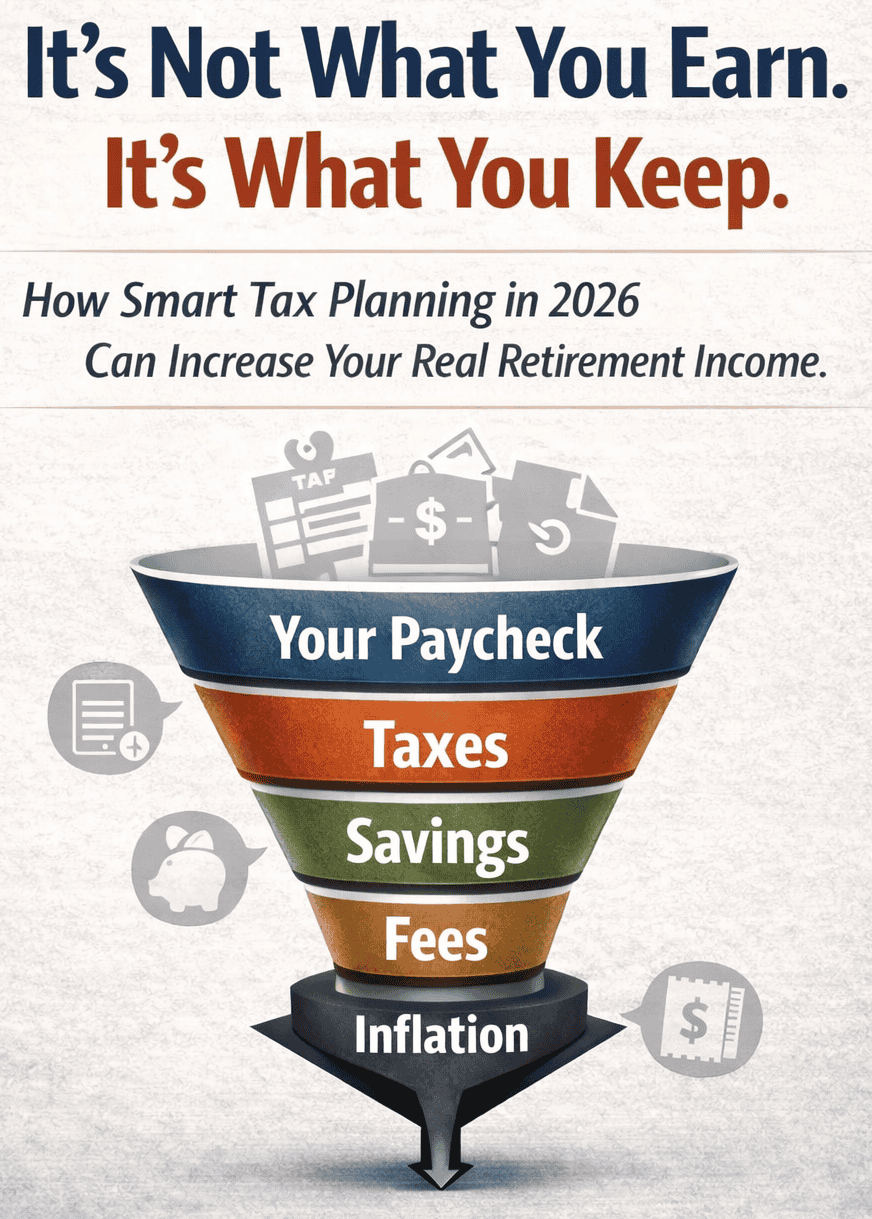

Your 2026 Tax Strategy: How to Pay Less Now and Create More Income in Retirement

When most people think about taxes, they think about April. Smart planning looks much further ahead. Because the truth is, you don’t retire on balances. You retire on after-tax income — what actually shows up in your bank account each month after the IRS takes its share. And the way you save, invest, and structure your taxes in 2026 can...

January 14, 2026

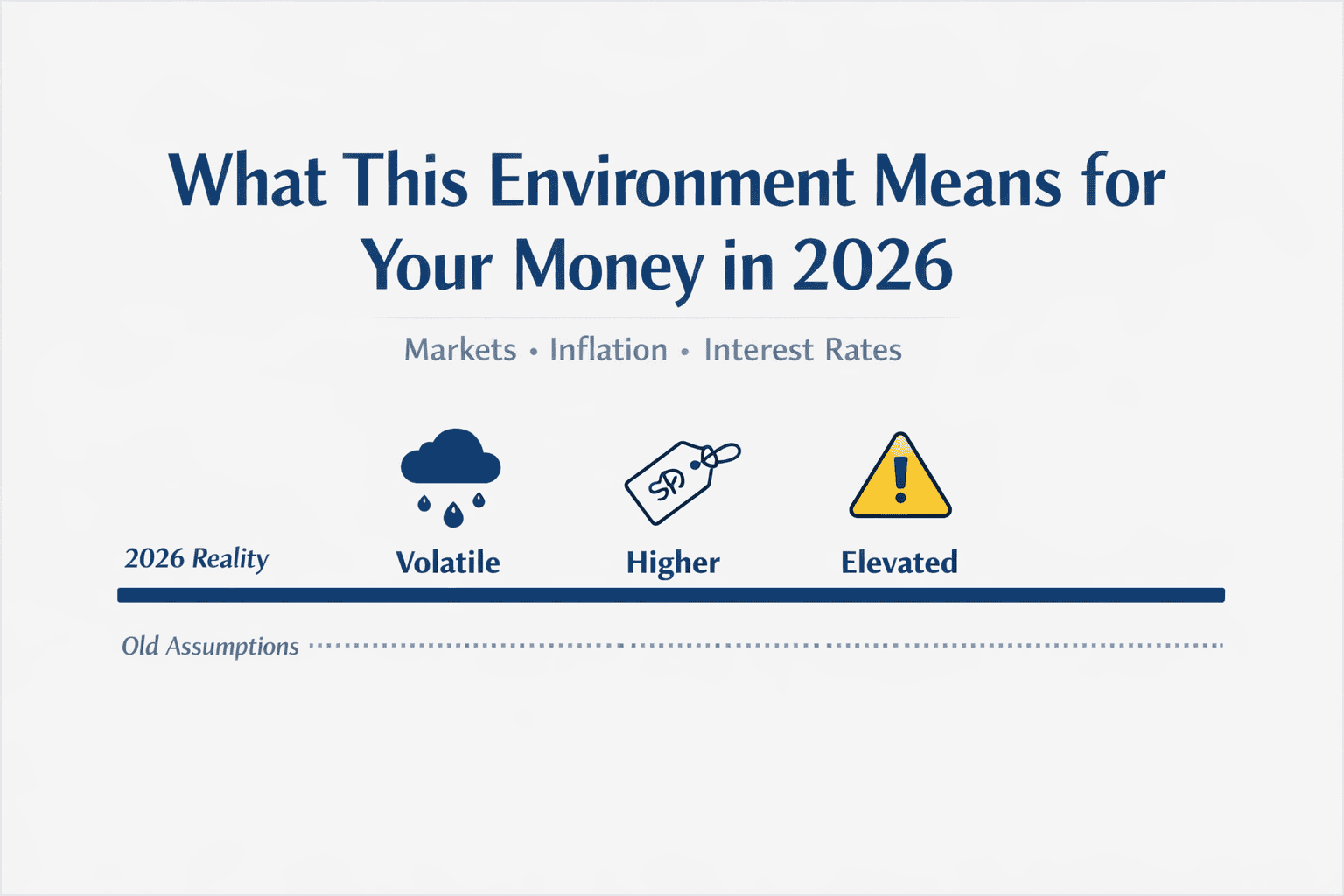

2025 Didn’t End the Way Most People Think It Did — Here’s What Really Happened

What the Markets, Inflation, and Interest Rates Actually Mean for Your Money in 2026 Here’s something worth paying attention to:The story most people are hearing about 2025 is missing some important context—and understanding what actually happened (versus what the headlines suggest) matters more than you might think. I’m not here to predict what happens next or tell you what to...

January 13, 2026

How the SEC and Regulatory Changes Are Shaping the Crypto Landscape

Cryptocurrency has been an unregulated Wild West for years, and while it still has its fair share of risks, we’re starting to see some structure around it. This article dives into the regulations shaping the future of crypto, what that means for investors, and how to stay on top of it all. How SEC’s Regulations Are Increasing Credibility Crypto’s Legitimacy ...

January 13, 2026

What Is Blockchain Technology?

The Future of Transparency and Security Blockchain technology isn’t just for cryptocurrencies, it’s a revolutionary tool that can transform how we handle transactions across a wide range of industries. From real estate to supply chain management, blockchain’s transparency and security are creating new opportunities to reduce fraud and streamline operations. Blockchain and Transparency: Reducing Fraud and Increasing Trust One of...

January 13, 2026

What Well-Prepared Couples Review Every January — Before Retirement

62% of pre-retirees are uncertain their savings will last through retirement. But here’s the thing: it’s rarely about how much you saved. It’s about whether you’ve reviewed the five areas that actually determine if your retirement works. Retirement issues rarely show up early. They show up later—when choices are limited, income matters more, and mistakes feel permanent. January is the...

January 9, 2026

Legitimacy and Value of Cryptocurrencies

Is Bitcoin Digital Gold? When you hear people talk about Bitcoin, it’s often in glowing terms. Some call it “digital gold,” others say it’s the future of money, but the question still remains: Why is Bitcoin valuable? In this article, I’ll explain why Bitcoin is considered a legitimate asset, how its fixed supply gives it intrinsic value, and why it...

January 9, 2026

Introduction to Cryptocurrency: The Basics You Need to Know

What is Cryptocurrency? Cryptocurrency has taken the financial world by storm, but for many, it’s still a bit of a mystery. In simple terms, cryptocurrency is a digital or virtual currency that uses blockchain technology for security. This means that transactions are transparent, secure, and not subject to the whims of banks or governments. When it comes to smart investing...

November 13, 2025

How to Minimize Taxes on An Inheritance

One of the most significant concerns for individuals receiving an inheritance is the potential tax implications. While inheritance laws and taxes vary by state, there are several strategies you can employ to minimize the taxes you owe when inheriting assets to make sure you don’t give away more than necessary to the government. Understand Estate Taxes and Inheritance Taxes First,...