November 12, 2025

What to Do With an Inheritance

Immediate Steps to Take After Receiving an Inheritance Dealing with an inheritance can be both an emotional and financial challenge. While you may be mourning the loss of a loved one, it’s essential to handle the financial aspects carefully to ensure that you make informed decisions and protect your future financial stability. After suffering the loss of a loved one,...

November 11, 2025

Why 2026 Could Be the Most Expensive Year of Your Retirement

Major Tax Changes Are Coming — And They Could Hit Harder Than You Expect As we close out 2025, it’s important to understand how federal tax laws are about to change — and why 2026 could significantly increase your tax exposure in retirement. Unless Congress passes new legislation, many of the tax breaks enacted under the 2017 Tax Cuts and...

November 11, 2025

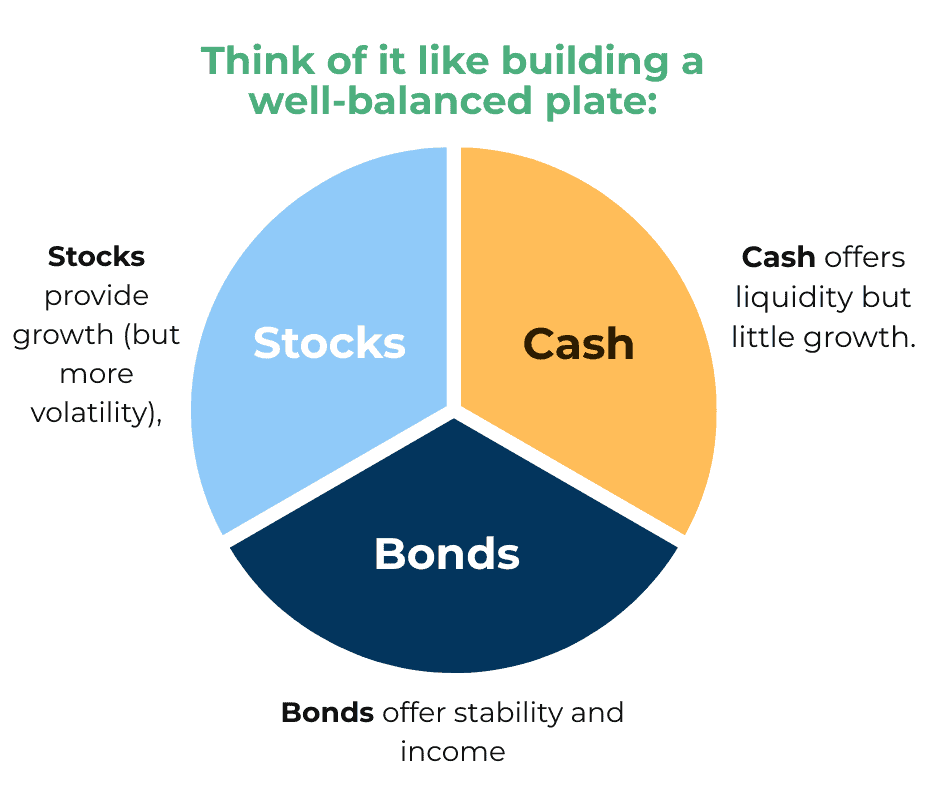

What Is Asset Allocation—And Why It Could Make or Break Your Retirement

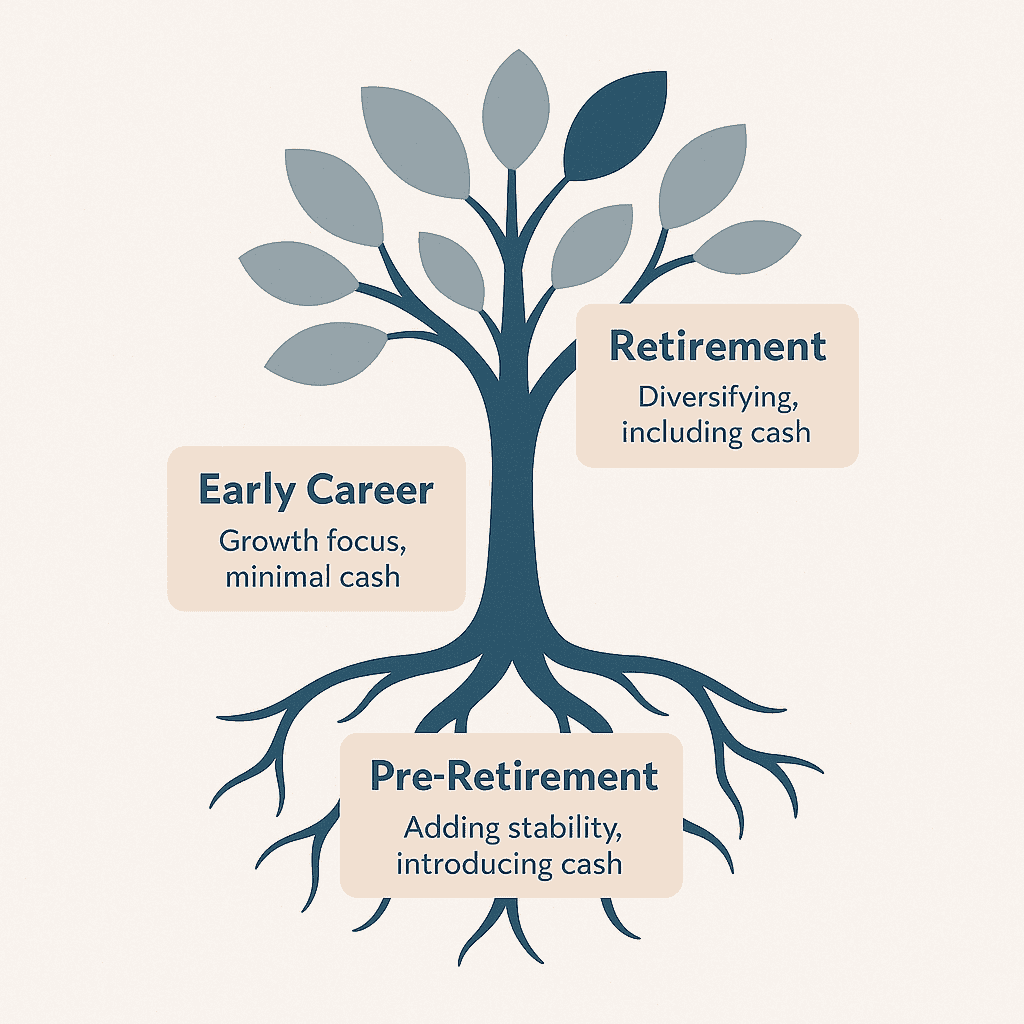

You’ve likely heard that diversification is key to investing, but how you actually allocate your assets—meaning how much of your portfolio is in stocks, bonds, and cash—can have a greater impact on your financial future than any single investment you choose. For retirees or those nearing retirement, asset allocation isn’t just a technical term—it’s one of the most important decisions...

November 11, 2025

The Fed Just Cut Rates—Now What?

If you’ve been watching economic headlines, you likely saw: the Fed recently cut its benchmark interest rate. This move isn’t just a macro-story—it carries practical consequences for your investments, income planning, and broader financial strategy. Let’s walk through what the rate cut means now, the remaining uncertainties, and some smart strategies you may want to consider. Why a Rate Cut...

November 11, 2025

Medicare vs. Long-Term Care — What’s Covered and What’s Not

Why Understanding the Gaps Can Save Your Retirement Plan What Most Retirees Overlook As you enter retirement, it’s natural to assume Medicare will cover most of your healthcare needs. But here’s the truth: Medicare covers short-term medical care, not long-term daily care. This misunderstanding leads to some of the biggest financial surprises in retirement. If you or a loved one...

November 11, 2025

Giving Tuesday: Smart Ways to Involve the Family in Legacy Planning

In 2024, the GivingTuesday Data Commons estimates that U.S. donors contributed approximately $3.6 billion—an increase of 16% compared to 2023. But beyond the headlines, what really matters for families is how to turn giving into a structured legacy and tax‑sensitive strategy. Why This Matters to Your Family Many parents and grandparents say they want to pass down more than wealth—they want...

November 11, 2025

5 Year-End Mistakes That Could Trigger a Tax Bill Next April

Avoiding Surprises at Tax Time Each year, millions of Americans are surprised by how much they owe at tax time. Often, it’s not because they made more money — it’s because they waited too long to review key items before December 31. According to IRS data, the most common mistakes leading to unexpected tax bills include underpaying estimated taxes, missing...

November 10, 2025

How Smart Social Security Timing Could Add Six Figures to Your Retirement

Most people know they need to decide when to take Social Security, but few realize just how much that decision can be worth. For many households, the difference between a reactive and proactive Social Security strategy can add six figures or more to their lifetime retirement income. Why Social Security Timing Matters More Than You Think Nearly 40% of retirees...

November 10, 2025

October Economic Update & Forecast

What’s Happening—and What It Means for You As we wrap up October 2025, there’s a lot happening in the economy. The Federal Reserve just cut interest rates again, job growth has slowed, trade tensions are making prices rise, and the stock market has been jumping up and down. These changes affect everyone—from people who are retired, to those getting close,...

October 21, 2025

How to Set Up and Administer a Group Retirement Plan for Small Business Owners

As a small business owner, setting up a group retirement plan for your employees can be one of the most rewarding decisions you make. It helps provide your team with financial security, increases employee satisfaction, and enhances your ability to attract and retain top talent. However, navigating the complexities of retirement plans can be overwhelming, especially for small business owners...

October 13, 2025

The Hidden Tax Costs of Retiring Too Early

You might dream of stopping work at 60 or even 55. That sounds nice: more time, more freedom. But there are hidden costs — especially in taxes, health care, and benefits — that many people don’t see until it’s too late. Health Insurance Before Medicare One big surprise is—you don’t get free health insurance until age 65 (Medicare). If you...

October 13, 2025

Digital Estate Planning: Protecting Passwords, Crypto, and Online Assets

You probably have dozens of online accounts, photos, and even investments you don’t think about every day. But when you’re not here (or if something happens), those digital assets need a plan too. Otherwise, your family could be locked out of important stuff—or worse. Here’s how to turn your digital life into a legacy, not a burden. What Counts as...

October 12, 2025

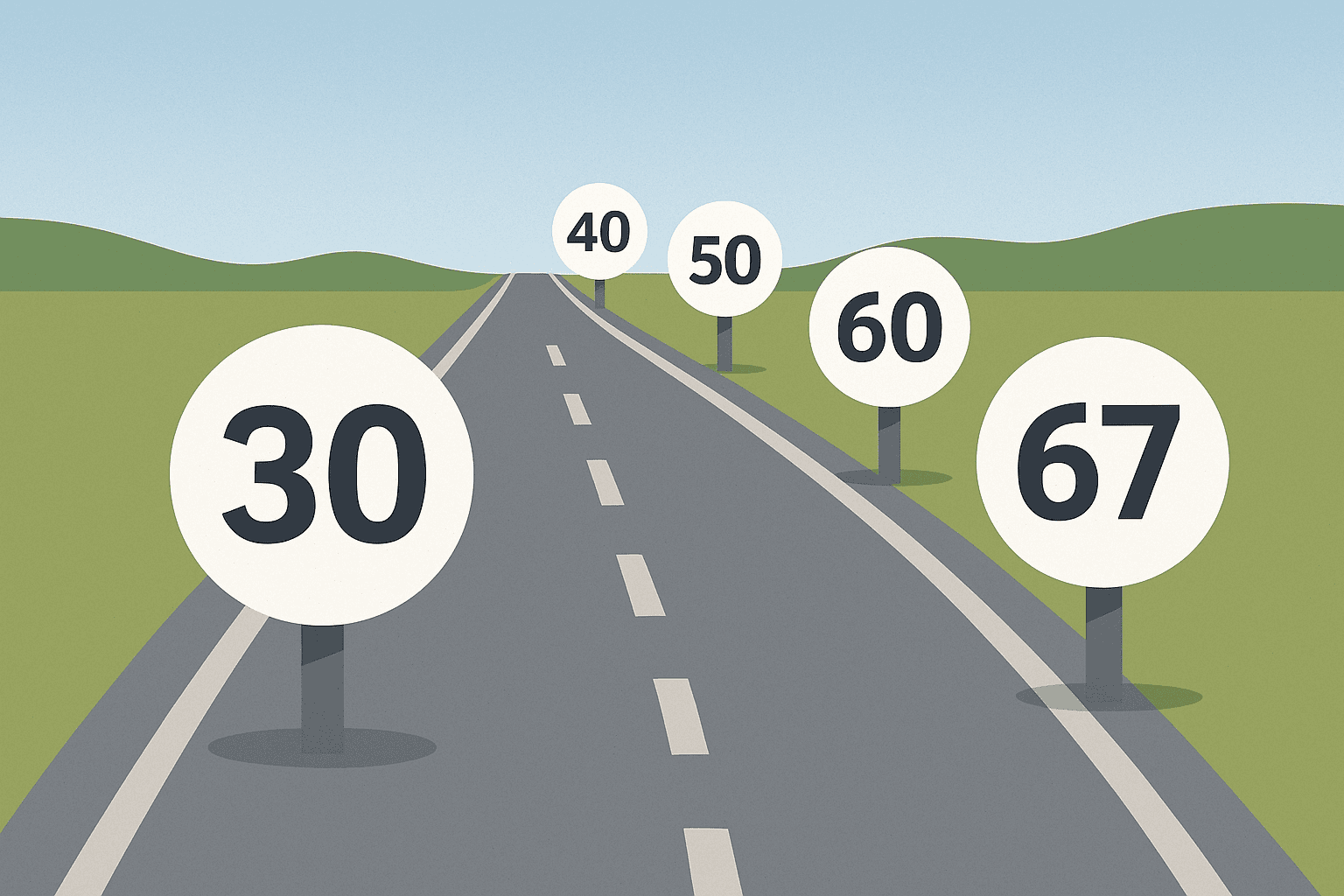

How Much Should I Have Saved in My 401(k) at Key Ages?

Many people wonder, “Am I on track with my 401(k)?” Having a few checkpoints can help you see where you stand — and what small changes can make a big difference. 401(k) Benchmarks: What Experts Suggest Financial planners often use income multiples as targets: Age Suggested Savings Target Why It Helps 30 1× your annual pay Get your footing early...

October 11, 2025

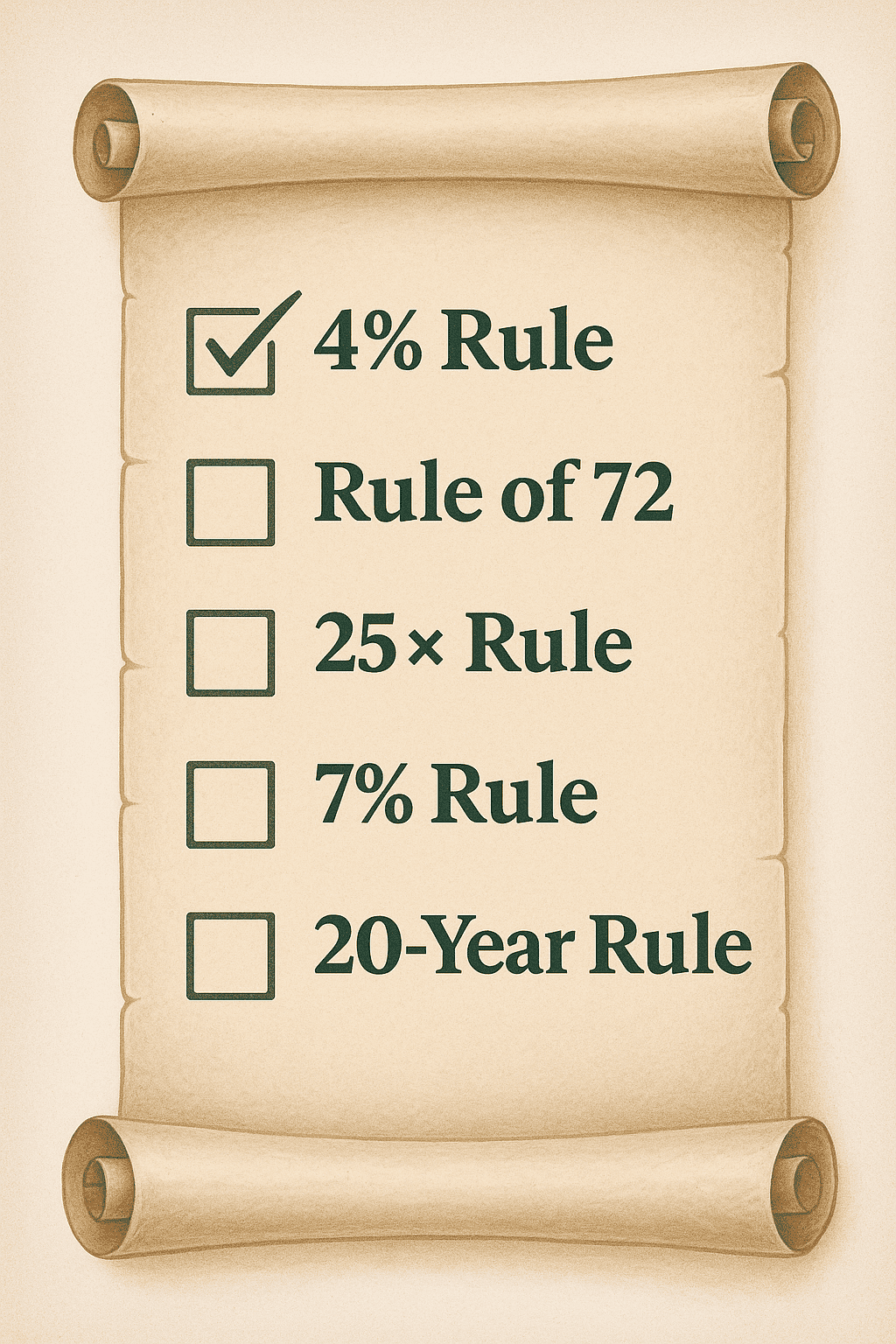

Retirement Rules of Thumb: Which Ones Help and Which Ones Hurt?

You’ve probably heard the “rules” of retirement: the 4% rule, the Rule of 72, “multiply your salary by 25.” They sound simple. But are they really good guides for your future — or can they do more harm than good? Let’s walk through the most common retirement rules, what they mean, and whether you should even pay attention to them....

October 11, 2025

Required Minimum Distributions: More Than Just a Tax Obligation

You may hear the term “RMD” and think, “Just another rule I have to follow.” But Required Minimum Distributions (RMDs) are more than a check-box. They impact your taxes, your giving, and even how you pass on your legacy. What Are RMDs and When Do They Start? RMDs are amounts the IRS requires you to withdraw each year from certain...

October 10, 2025

Trump Accounts: What to Know About the New $1,000 Government-Backed Savings Accounts

A new program included in the 2025 One Big Beautiful Bill has created “Trump Accounts” (officially called MAGA Accounts: Money Accounts for Growth and Advancement). These accounts aim to help children save for education, homeownership, and entrepreneurship — but the rules are detailed, and not everyone will qualify. Here’s what families need to know. What Are Trump Accounts? Who Qualifies?...

October 10, 2025

The Role of Cash in a Retirement Portfolio

Cash feels safe. You can see it. You don’t have to worry about stock prices. But too much cash—or too little—can hurt your long-term retirement goals. Let’s walk through how cash fits into your plan, how it changes with life stage, and how to figure out the right balance. Why Many Retirees Hold Too Much (or Too Little) Surveys show...

October 10, 2025

October Economic Forecast: What the Market and Economy May See in 2025

The U.S. economy is sending mixed signals as we enter the last quarter of 2025. Rate cuts, GDP surprises, inflation pressures, and job market shifts all shape what’s ahead. While no forecast is perfect, looking at the data together helps us better understand where the economy and markets may be heading. Fed Cuts Interest Rates — and Signals More to...

October 9, 2025

Tax Planning Before Medicare: Avoiding Costly Surprises

Thinking about the years before 65? The decisions you make then can affect your taxes — and your health care costs — for decades. Many people treat the “gap years” between retirement and Medicare as a soft spot. But with smart planning, you can turn them into an advantage. Why Medicare & Taxes Are Connected When you enroll in Medicare...